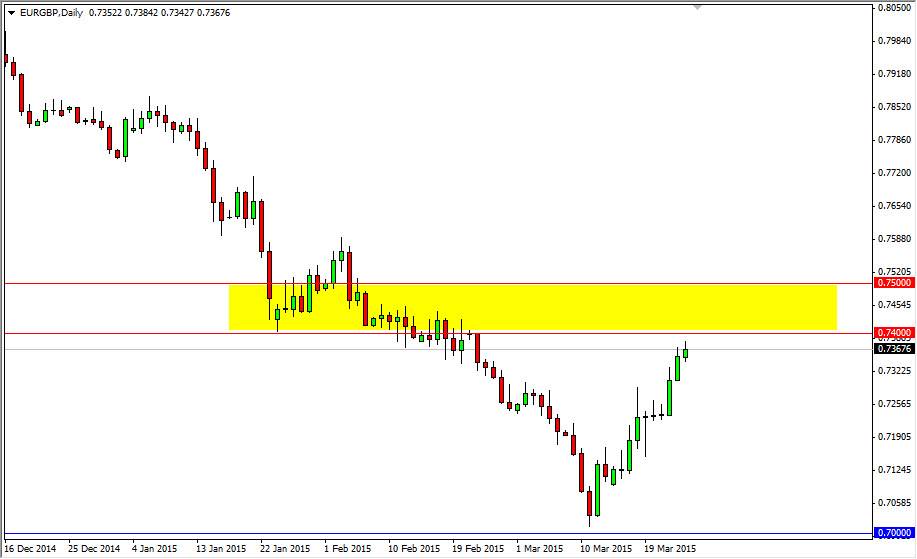

The EUR/GBP pair tried to rally during the course of the session on Wednesday, but as you can see failed just below the 0.74 handle. This is an area that I anticipated seeing quite a bit of resistance at, and I also expect it to extend to the 0.75 handle. With that, I think that it makes sense that we may get an opportunity to start selling yet again. I think that the Euro looks like it’s going to soften up against most currencies at the moment, and I don’t think that this marketplace is going to be a lot different. I believe that a break below the bottom of the range for the Wednesday session is reason enough to start selling as the market should then head to the 0.70 level given enough time.

The area above that I have marked on this chart with a yellow box is an area that I would anticipate seeing quite a bit of selling pressure at. Any resistive candle in that area would also be a nice selling opportunity as far as I can see. I recognize that the Euro and the Pound are both getting a bit soft at this point, but it’s the Euro that’s really causing the most problems for currency traders around the world. With that being said, I believe that the relative strength will still remain with the British pound in this pair.

Selling rallies

If all you have done over the last several months in this pair has been selling rallies, you are doing quite well. Ultimately, the market continues to sell off, and really at this point time I don’t see anything on this chart the changes the trend or changes my opinion of where this markets going. Ultimately, the market will more than likely break down below the 0.70 handle, as the market should continue to sell the Euro in general. Ultimately, I have no interest in buying this pair until we get above the 0.78 handle, something that isn’t going to happen anytime soon.