EUR/USD Signal Update

Last Thursday’s signals provided a fast short entry which would have been stopped out for a loss when the price rose above 1.1015 before falling sharply later.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made between 8am and 5pm London time only.

Long Trade 1

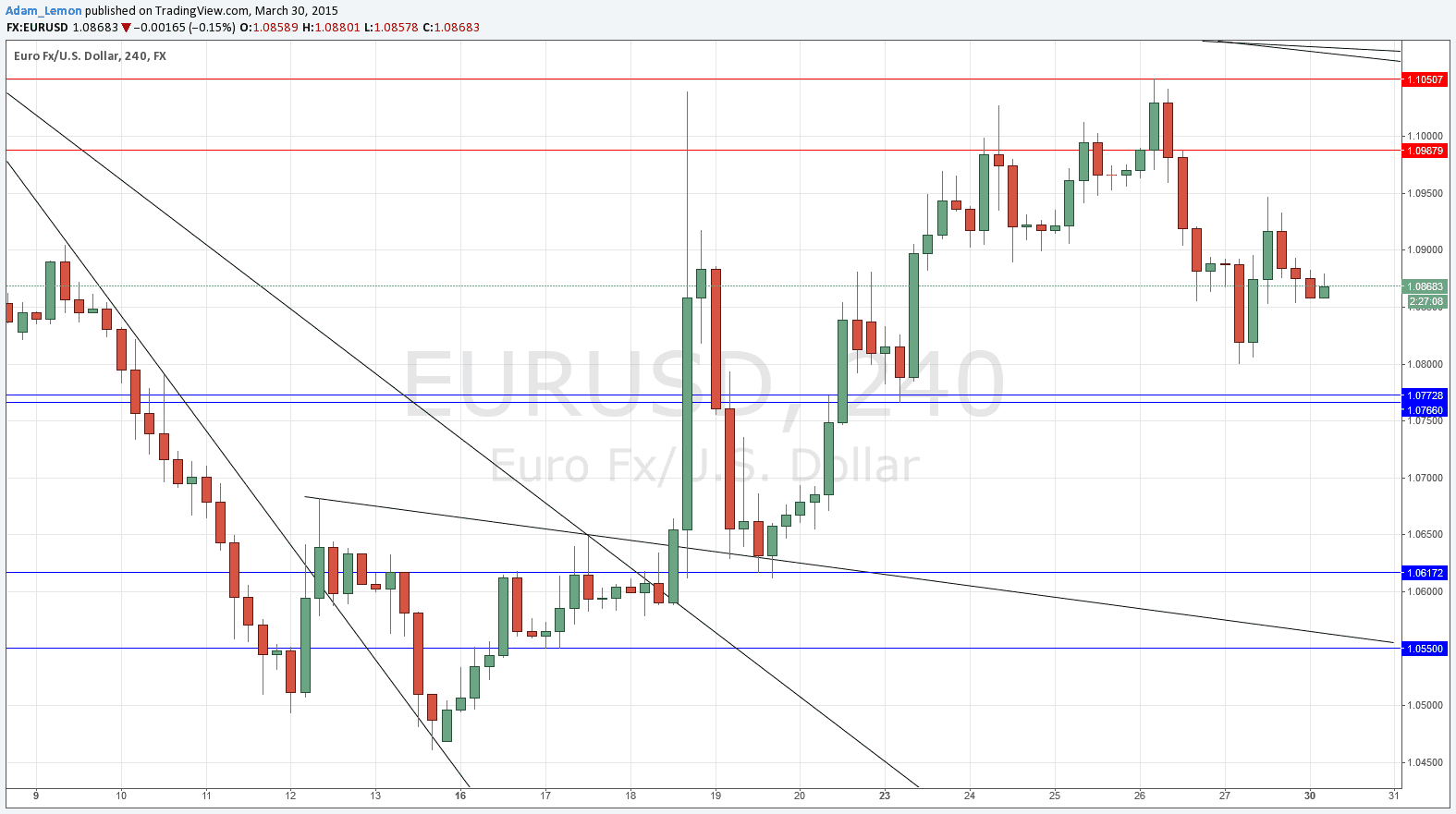

Go long following a bullish price action reversal on the H1 time frame immediately upon the first entry into the area between 1.0773 and 1.0766.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the first entry into the area between 1.0988 and 1.1051.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

I forecast last Thursday that price stabs up above the 1.1000 level would probably be good selling opportunities and that was certainly correct, with the price falling later that day sharply from a high of 1.1051. Unfortunately that move up stopped out my earlier short trade and probably would have stopped out a lot of traders. It was probably a good example of how a strong cluster of obvious stops can be uncovered to drive liquidity and “un-crowd” a developing trade.

The price may well continue to fall but the action will probably be choppy on the way down if so.

There is a probable support level just below 1.0775. Another return to 1.1000 would most likely see another bearish reversal.

There are no high-impact events scheduled today concerning the USD. Regarding the EUR, there will be a release of Preliminary German CPI data at some unspecified time today during German business hours.