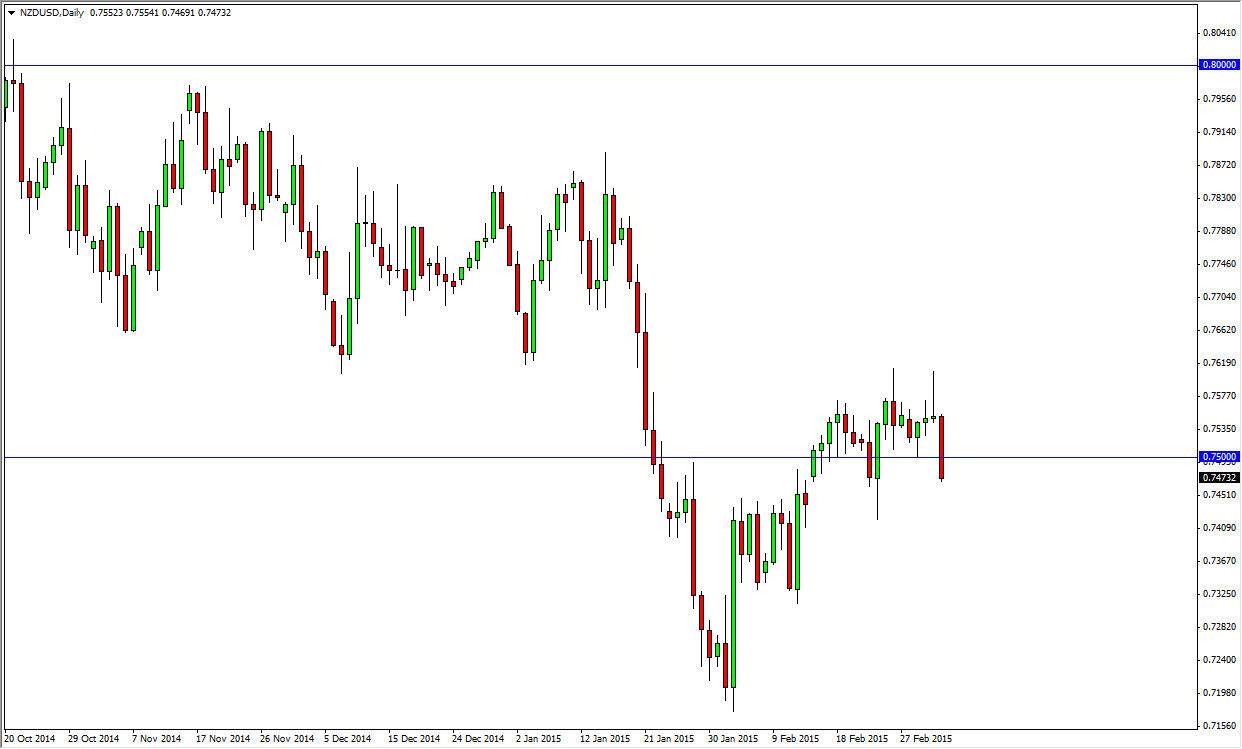

The NZD/USD pair fell during the session on Thursday, as we continue to see a downward move in this pair. It makes perfect sense though, as the New Zealand dollar of course is highly sensitive to the commodity markets overall. With that, as long as there is a dampening of risk appetite when it comes to commodities, the New Zealand dollar should continue to see sellers.

Keep in mind that the Royal Bank of New Zealand continued to talk down the value of the Kiwi recently, and even went so far as to suggest that the market should be closer to the 0.68 level, as it is “fair value.” Not only did they jawbone this market lower, they even got in and sold off the New Zealand dollar as well. With that, it’s very likely that this market will continue to go lower, under just about any set of circumstances going forward. I basically look at this market as one that offers value every time it rallies, because the US dollar of course is much more trusted than the New Zealand dollar at this point.

Selling rallies, as well as breakdowns

I obviously am going to sell rallies every time we get one and there is a resistive candle above, just as I am willing to sell a market that breaks down. I believe that if we can get below the 0.7450 level, this market will continue to go down to the 0.73 level, and possibly the 0.7150 handle. Rallies at this point in time that show signs of resistance would be sold as well, as I believe that there is a bit of a “ceiling” in the marketplace close to the 0.7650 handle as it was once massively supportive. That of course is a basic tenet of technical analysis, as support becomes resistance and vice versa. Ultimately, I have no interest in buying this pair even above the 0.7650 level, as there is so much noise just above that area as well. I remain bearish.