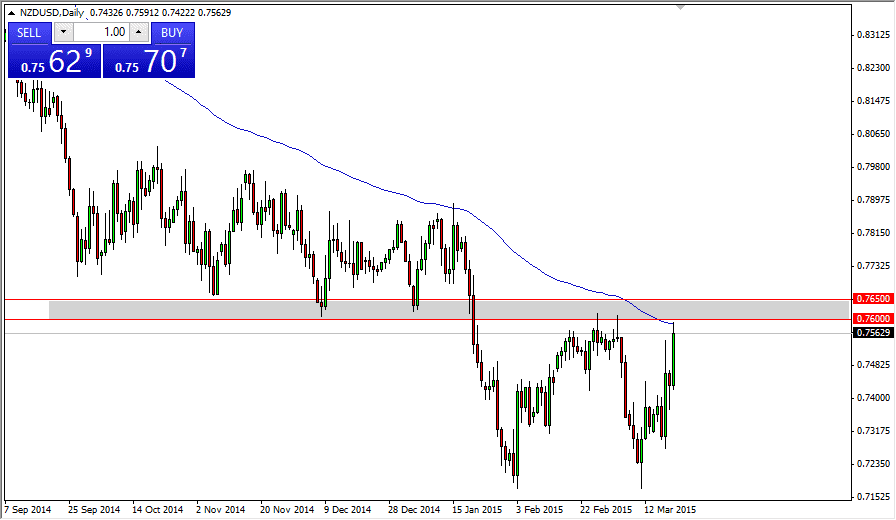

The NZD/USD pair rallied during the session on Friday, but as you can see slammed into the resistance barrier that I have been paying attention to. I believe that the 0.76 level is the beginning of a 50 pip resistance barrier, as marked upon the chart. Another thing that I would notice here is that the 100 day exponential moving average is touching the top of the candle for the session, so I believe that we are going to start seeing a bit of resistance in the general vicinity. But then, I am simply looking for resistant candle in order to start selling the New Zealand dollar, as I do not trust any type of rally at this point in time.

Pay attention to the commodity markets, as they could give us a bit of a “heads up” when it comes to the Kiwi dollar. After all, it’s probably only a matter of time before the commodity markets start to lose value yet again, and with that the New Zealand dollar typically does fairly poorly. Remember that the Kiwi dollar tends to be about the general attitude of commodity markets, and not a specific commodity market. Because of this, it is an excellent risk appetite barometer as well.

Being patient will pay

I believe that being patient in this market might be the best way to get out. I believe that it’s only a matter of time before the seller step back and, and as a result I think simply waiting for the proper setup is about the only thing you can do at this point. I will be looking for resistant candles on the daily chart obviously, but also on the four-hour chart. I believe that once we get the proper resistance, this market will more than likely head back to the 0.75 level first, and then possibly head down to the 0.70 level given enough time. Remember, the New Zealand dollar recently said that fair value in this pair is closer to the 0.68 handle.