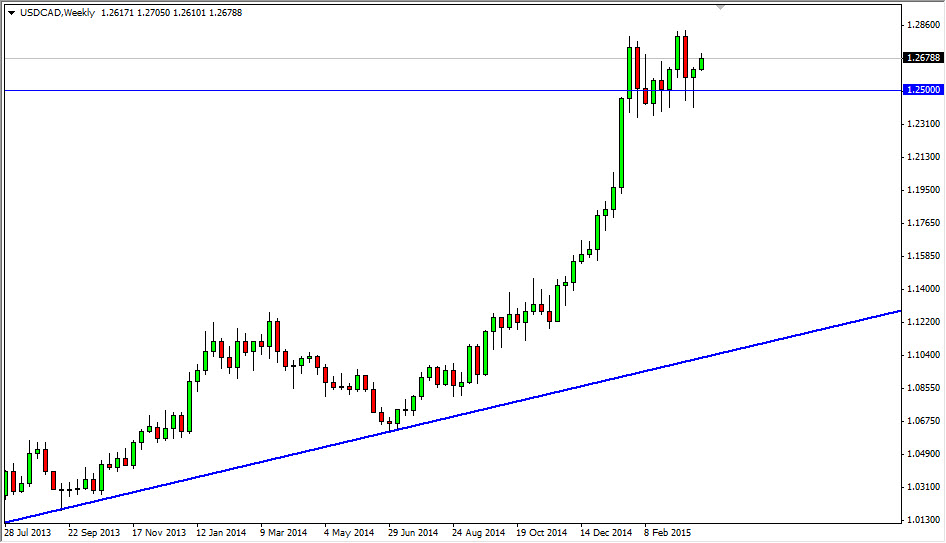

The USD/CAD pair has been bouncing around just above the 1.24 level for some time now. I believe that this is simply the market trying to build up enough momentum to finally break out again. The 1.30 level above is massively resistive, and in fact was where the market stopped after the financial crisis. With that being the case, I think that it is going to take a significant amount of momentum to break out, and that’s essentially what we are trying to build up.

We are at very significant levels in both this currency pair and energy markets. I believe that the energy markets will continue to be bearish, with oil prices dropping. I believe that the $50 level in both the Light Sweet Crude and the Brent market is extraordinarily important. Both of those levels are being tested in general, and it will take a break below those levels in order to push this market above the aforementioned 1.30 handle.

[CAD:FXAcademy CTA #121]I believe this month will be more of the same

I think that the April range in this marketplace will be very much the same as the market range. I don’t know that we’re going to have the significant breakdown in oil prices quite yet that are needed to push this pair that much higher. That’s not to say that I’m willing to short this pair, just that I am willing to buy it for short-term trades on dips. Ultimately, there’s no way whatsoever to know when this market breaks out to the upside, but I just don’t feel that there is enough momentum yet. After all, looking at the massive move higher you can see that it wouldn’t be much of a surprise to grind sideways for some time.

I believe that there is a significant floor in this market at the 1.24 handle, and then again at the 1.20 handle. Either way, I am more than willing to buy supportive candles in those regions, and have no interest in selling. Ultimately though, if we can break above the 1.30 handle, this will be a “buy-and-hold” type of situation.