USD/JPY Signal Update

Last Thursday’s signal was not triggered and expired.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

Long entry following some bullish price action on the H1 time frame immediately upon the first test of 120.40.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry following some bullish price action on the H1 time frame immediately upon the first test of 119.79.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

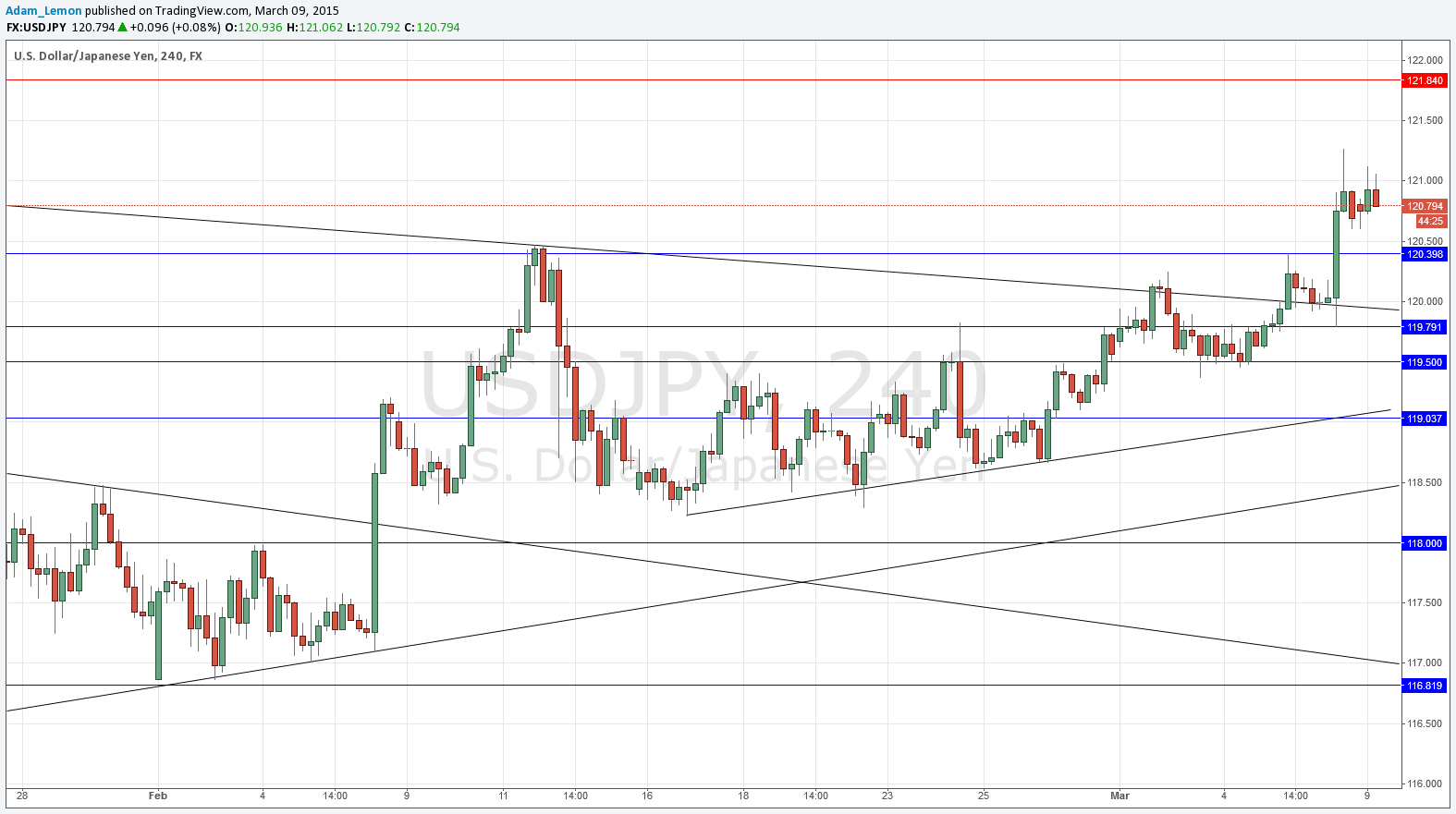

I forecast last Thursday that there would be an edge in being positioned long before the NFP data release on Friday, and this was correct, with the positive USD data driving the pair up to levels close to the multi-year high made a few months ago. However the price has fallen back somewhat since that high and now looks as if it will challenge possible support levels later today.

I see 119.79 as potentially better support as 120.40 as the price action currently looks bearish enough to push the price down, with the USD being perhaps overbought across the board. The support at 119.79 is also fairly confluent with a bullish trend line which should add to its strength.

The multi-year high at 121.84 looks likely to hold as it has not been reached yet even with this strong data, so it should be a good area to find a short trade.

There are no high-impact events scheduled today for either the JPY or the USD today. Therefore it will probably be a quiet day for this pair.