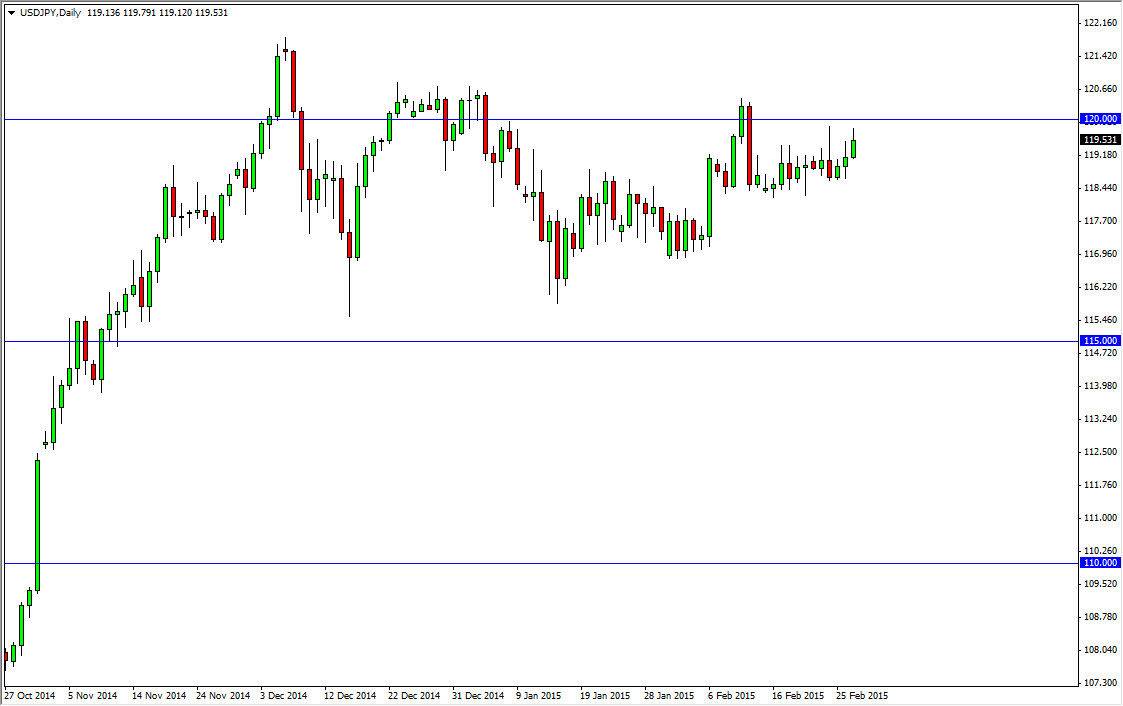

The USD/JPY pair surge higher during the session on Friday, but as you can see struggled at the 120 level. With that being the case, I think that this market continues to find a bit of resistance there, but ultimately I believe that the US dollar will continue to strengthen overall and continue to climb against most currencies, with the Japanese yen being no different. With this, I look at short-term pullbacks as potential buying opportunities, as well as a daily close above the 120 handle.

I think that ultimately there is a significant amount of support below at the 118.50 level, as well as the 118 level, and then the 117 level. That being the case, any type of supportive candle at one of those areas would be reason enough for me to start buying. I think that ultimately we go much higher, but in the meantime we might have a lot of short-term trading opportunities to the upside. I have no interest in selling this marketplace, because I think that there are far too many areas where you can run into trouble.

Longer-term uptrend

I think that there’s no way to sell this market going forward, and it is not until we get below the 150 level that I would even see the possibility of doing so. The longer-term charts, the weekly chart that is, to show a bullish flag, and the bullish flag measures from the 105 level all the way to the 120 level. With that, we should essentially head to the 135 level given enough time. However, the markets will continue to be very choppy, and there will be times of course where we will pull back. Every time we pullback I look at this market as offering value, and therefore will continue to buy the US dollar. Ultimately, it would not surprise me at all to go to 135, but that’s a longer-term target, probably by the end of the year. I really don’t see an opportunity to sell at all. It simply is not worth getting in front of this freight train.