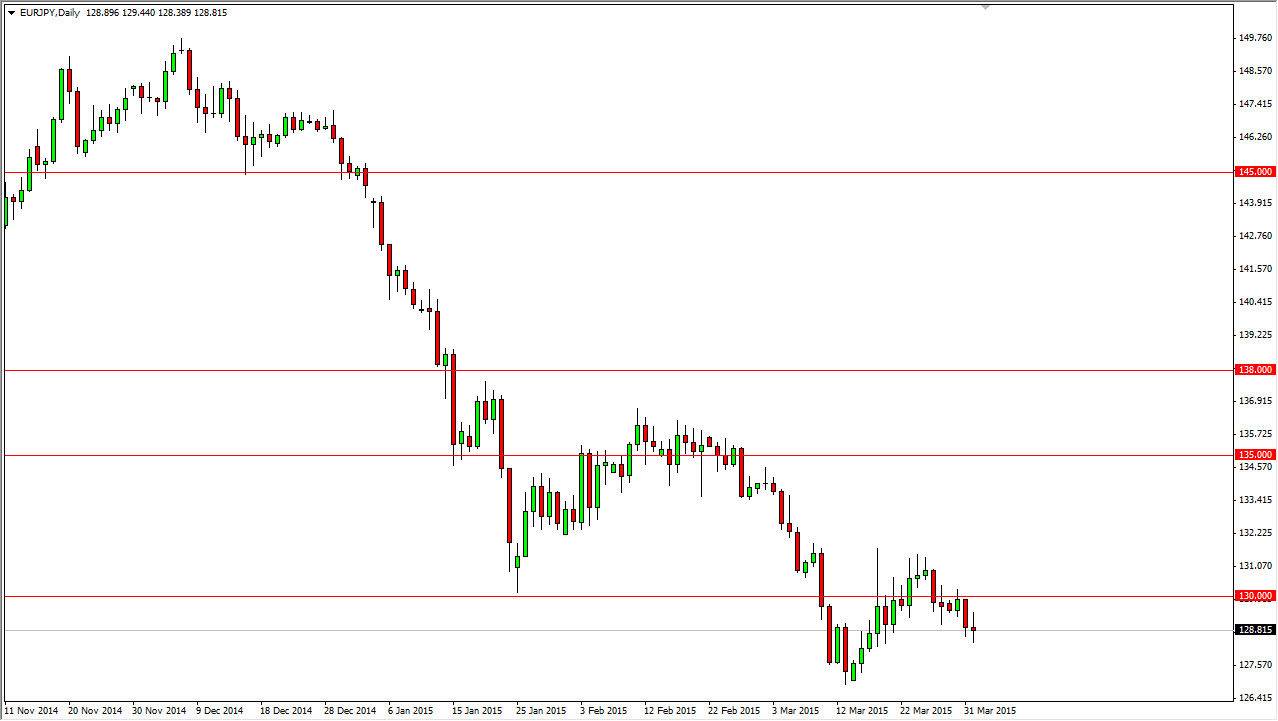

The EUR/JPY pair went back and forth during the course of the day on Wednesday, as the 129 level offered a bit of resistance. It seems as if the resistance runs all the way to at least the 131 handle, so at this point in time I have absolutely no interest in buying this market. Rallies should continue to offer selling opportunities in what is obviously a very bearish market. I think that a break below the bottom of the range for the session on Wednesday is also a selling opportunity, as we should then head to the 127 level rather quickly. I also believe that we go below there, probably heading for the 125 area next.

I think that the Euro continues to struggle in general, and therefore it’s going to be difficult for this pair to go to the upside, even though the Japanese yen is in exactly stellar at the moment either. The Euro continues to be the weakest currency that we deal with on a consistent basis, so I really don’t see the opportunity to go long of it yet.

Long-term signals

I don’t think that it’s going to be possible to buy this pair until there’s some type of longer-term signal that forms. Ultimately, I think that I will have to see some type of supportive candle or even bullish candle on at least a weekly timeframe in order to feel comfortable buying this pair. I think that ultimately this market should offer plenty of selling opportunities for the foreseeable future, and therefore I’ve got no interest at this point.

In fact, I think there is significant resistance all the way to at least the 138 handle. With that, it’s very unlikely that I will be buying this pair anytime soon, and therefore I think that it’s going to be sell and sell again. Ultimately, with the Nonfarm Payroll numbers coming out on Friday, we might have a lack of volatility, as this is an extremely sensitive pair when it comes to risk appetite.