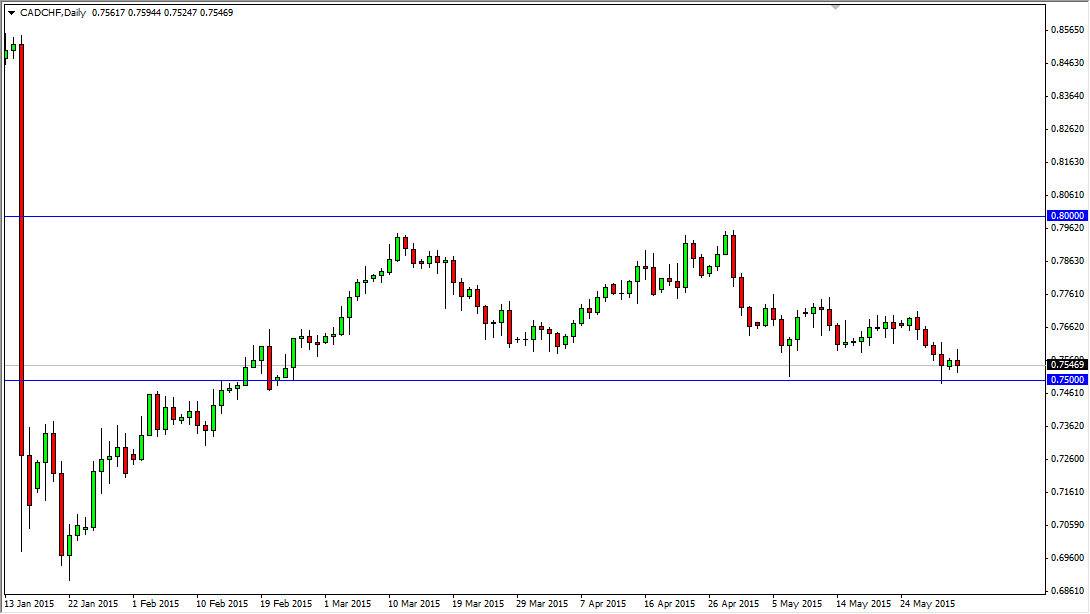

The CAD/CHF pair initially tried to rally during the day on Monday, but found the 0.76 level to be far too resistive. With this, the market pullback and formed a bit of a shooting star. I see that the 0.75 level is just below, and it is in fact an area that has been supportive in the past. I believe that this market will eventually break down below there, and continue to go much lower. At this point in time, it is difficult to want to own Canadian dollars at the expense of Swiss francs, simply because there is a lot of concern out there. Also, the oil markets are quite a bit more volatile recently than they have been, and that of course has an effect on the Canadian dollar itself.

The shape of the candle is of course very bearish, but it also suggests that less and less people are willing to step in and support the Canadian dollar in this general vicinity. With that, I think that it’s only a matter of time before the sellers finally take over again.

Commodities

The commodity markets in general look rather volatile and perhaps dangerous, so I’m not a big fan of owning commodity currencies right now. While I think the US seller might be a bit overbought, at the end of the day commodities are falling not only based upon the US dollar, but based upon lack of demand. Ultimately, I think that this pair drops to the 0.70 level, which of course is a larger support level based upon the psychological significance.

Only other hand, if we can break above the 0.76 level that of course is a very positive sign. That probably sends this market looking for the 0.77 handle, and if we can get above there probably even to the 0.80 level given enough time. I don’t think that’s going to happen, but it is the other side of the coin if you will.