The CAD/CHF pair is one that I like a lot because it represents a “risk on/risk off” type environment. That's wrong, I think it’s a bit harsh to consider the Canadian dollar a “risky currency”, but at the end of the day it is highly influenced by oil. Quite frankly, I trust Canadian finance is better than my own in the United States, but I digress.

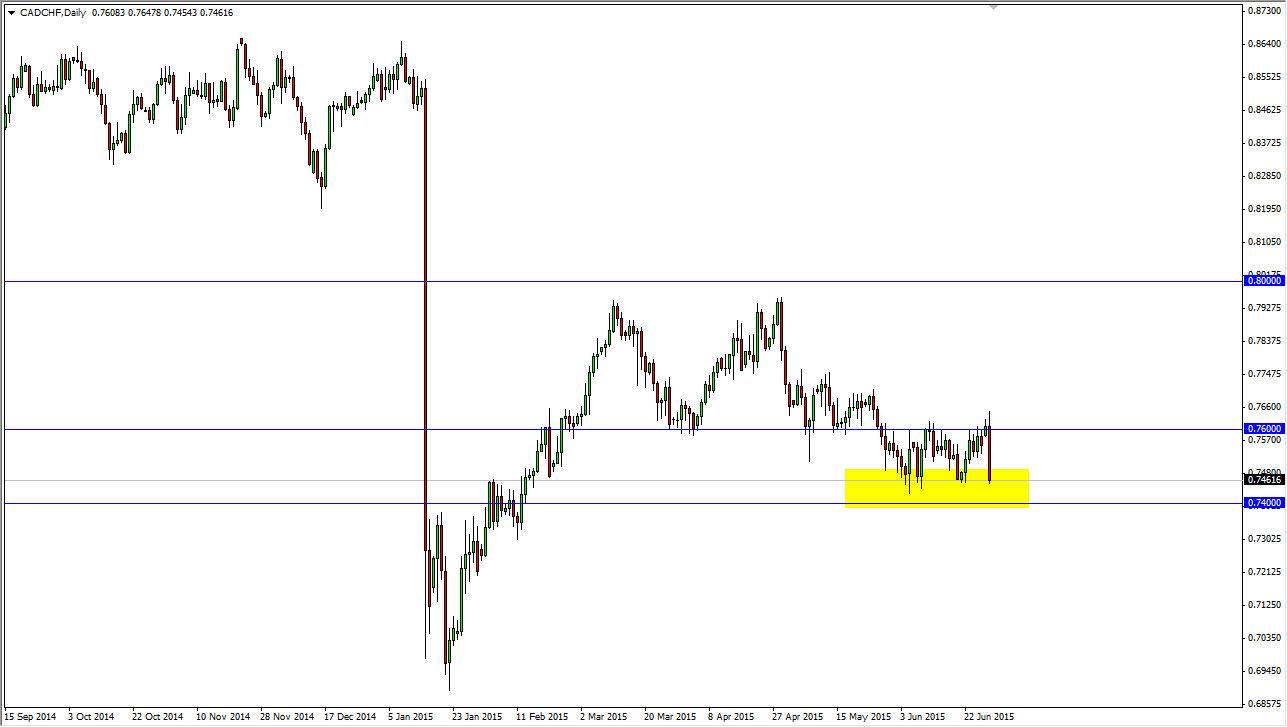

Looking at this chart, you can see I have a yellow box drawn just above the .74 level. This is an area that has been supportive several times now, so I think we may see an attempt to bounce from here. However, you have to keep in mind that we are closing towards the bottom of a very bearish candle, and that often can signal that we're about to break out. So having said that, I have come up with a couple of scenarios for trading this particular currency pair.

Playing bounces, and breakdowns

I believe that if we get a bounce from here, and perhaps break back above the 0.75 level, you can take a short-term long position and aim for the 0.76 handle. On the other hand, if we can break down below the 0.74 level, I think you can start selling as the market will more than likely head towards the 0.70 handle. Keep in mind, the Canadian dollar is highly influenced by the oil markets, and as a result it is likely to have quite a bit of influence from that sector. That is a part of the world right now that is very scary at times, and highly influenced by what happens in the US dollar. In other words, you are essentially trading 3 currencies and a commodity at the same time with this type of environment. Who says Forex is boring?

Ultimately though I think if you keep those levels in mind, it makes this pair easier to trade. By having a couple of set “trigger price is”, you can place your trade and get involved.