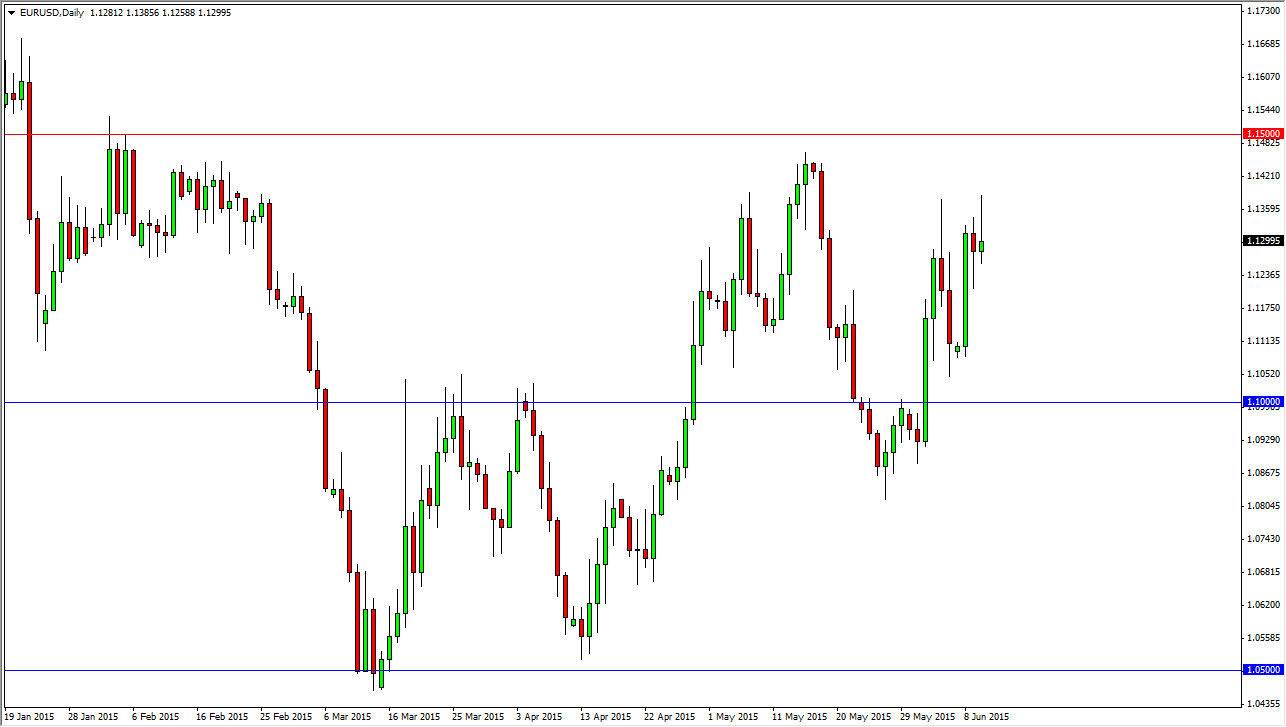

The EUR/USD pair initially rallied during the session on Wednesday, but found the 1.14 level to be a bit too resistive. By doing so, we ended up turning things back around and forming a shooting star. Because of this, I feel that this market isn’t quite ready to make any serious moves, and I feel that we are now starting to see this market tighten up a little bit. The biggest problem with this market at the moment is that immediately preceding the shooting star that we formed during the Wednesday session is a hammer on the Tuesday session. This essentially means that the market doesn’t know what it wants to do. It puts “fair value” at roughly 1.13, which is about where we said as I write this. In other words, I would anticipate quite a bit of sideways action in the short-term.

Longer-term bullish.

I am longer-term bullish in this market, but I recognize that there is a lot of negativity coming out of Europe that we will have to be able to work around. The Greeks of course have their part to play, but at the end of the day I do not anticipate that the Greeks are suddenly going to be okay with leaving the European Union. They will do what they need to do in order to patch up the mess yet again. This will give us an opportunity to start buying euros again, at least for a while.

If we can get above the 1.15 level, I feel that the change of trends will be somewhat official, and as a result the buyers will more than likely continue to enter the market every time it pulls back. I do recognize that the 1.10 level should be supportive, and I think it would take a move below the 1.09 level for me to get serious about selling. In the meantime, if I have to put a position on, it will be to the upside but to be honest it’s probably going to be a few days before I do that.