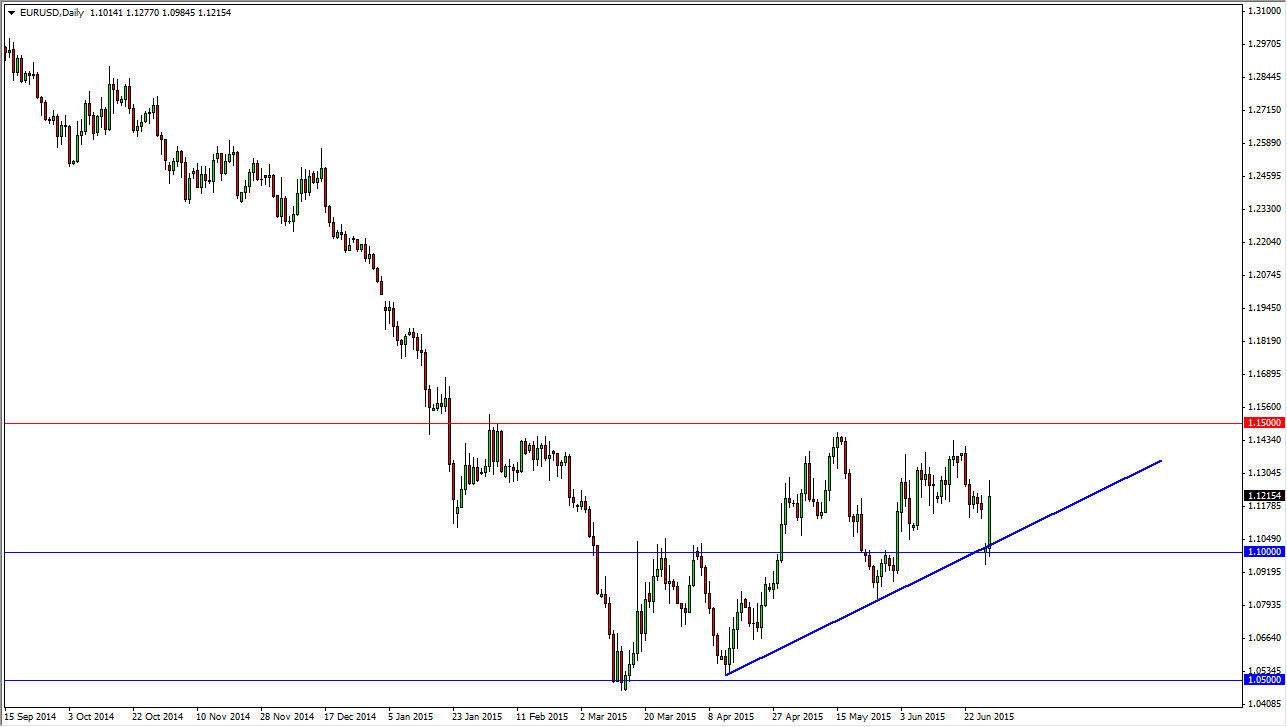

The EUR/USD pair broke higher during the course of the day on Monday after initially gapping massively. Quite frankly, the fact that we gapped that low and turned back around to not only fill the gap, but to continue going higher is a very impressive sign. With that, we believe that it’s only a matter of time before we have a buyer when we break down. Quite frankly, this marketplace is one that will continue to see quite a bit of volatility, but at the same time we also believe that there is some stability and the fact that there are what we would consider to be “smart money” players below picking up the Euro every time it falls in value.

Looking for a trend change

I think that it’s only a matter time before you get a trend change, and that would be a break above the 1.15 level. In the meantime, I think there is going to be a lot of volatility and that shouldn’t be much of a surprise with everything that’s been going on with Greece. I think that short-term pullbacks offer value, and that the market recognizes that as true. I personally am keeping my position size fairly small though, because quite frankly this type of volatility can give you headaches.

That being said, if you can hang onto the position through the volatility, you should do quite well. That is the reason for keeping your position size small. Quite frankly, if the Greeks do default, ultimately that will probably market the bottom of this pair. Don’t get me wrong, we will fall precipitously in the short-term, but eventually getting rid of the Greeks would be a huge thing working in the favor of the European Union once all the write-downs were taken. I have no illusions of that happening quickly, but if that does happen, I’m starting to think about buying this pair for longer-term trades as soon as I see signs of stability and simply adding as we go higher.