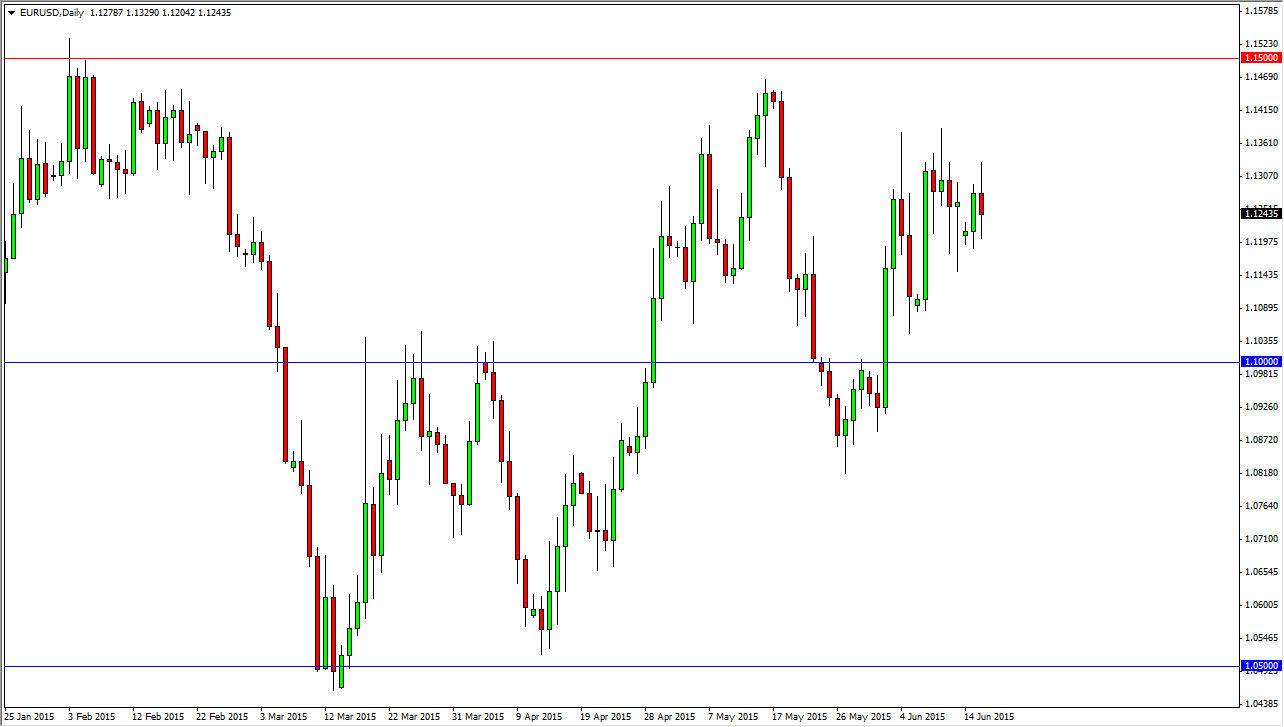

The EUR/USD pair went back and forth in a volatile session on Wednesday, as the market continues to focus on the tight consolidation area that we have been in for roughly 2 weeks. This market continues to look like it is trying to break out to the upside, provides there are plenty of reasons to be concerned at the moment. One of the biggest ones actually happens today, and that is the FOMC meeting minutes. It is because of this that I anticipate seeing some type of volatility and you never know, we might even get an actual move! However, I have very specific levels to get me interested in piling into this pair.

The very first one for my money is going to be the 1.15 level. If we can finally break above there I think this market can finally break out to a longer-term “buy-and-hold” type of mentality. I do not think that it’s going to happen right away, but perhaps the FOMC will give us something to perhaps build that momentum so that we can finally break out. In the meantime, I believe that we are playing a much tighter range.

Tight range

I still think that we are essentially stuck between the 1.11 level on the bottom, and the 1.14 level on the top. However, I do recognize that recently we have been plowing a little bit more to the upside so I think that perhaps the range is even tighter that was just last week. I think the 1.12 level is starting to become a “floor” in this market.

I believe that there is a significant amount of resistance between the 1.14 and the 1.15 level, so it’s not going to be an easy move to make. However, I also recognize that it’s very likely that the market will eventually get above there. I believe this is going to be difficult but I think it’s somewhat inevitable as the European Union doesn’t look like it’s ready to completely fall apart. It’s basically what’s been priced in, and that’s a bit much.