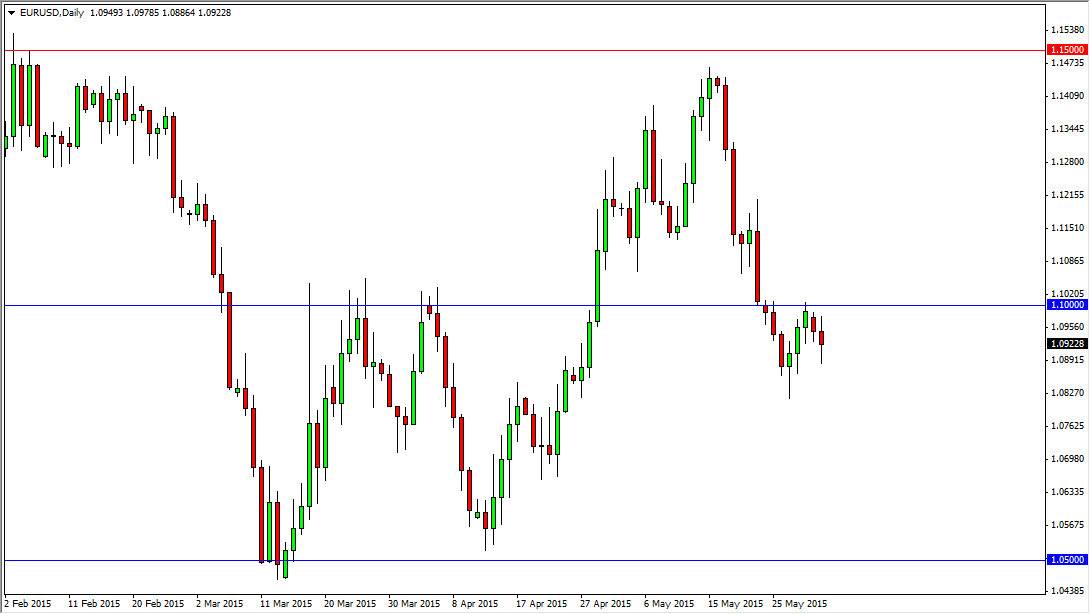

The EUR/USD pair had a very volatile session on Monday, as we continue to test the 1.10 level. This is an area of the chart that is rather resistive, and as a result I believe that breaking above it is in fact going to be very bullish sign. Right now, it does look like we are going to at least attempt to do so. With this, I am a buyer above the 1.10 level, especially if we get a daily close that is at least 50 pips above there.

On the other hand, this is a market that could break down. If we get down below the 1.08 level, it would not only break down below a support barrier, but it would also break down below the bottom of the hammer from last week which of course in and of itself is a rather supportive sign. If we get below there, things could get ugly rather quickly, and the Euro could end up heading back to the 1.06 level in fairly short time.

Volatility

The market will be volatile regardless. Until we break above the 1.10 level, or below the 1.08 level, I don’t really have any interest in being involved in this market, as I think it will be very difficult to trade. I believe that it will only be a matter of time before major problems happen, which of course will send this market in one direction or the other. In the meantime, in these 200 pips, I think there is nothing but noise. The Monday session certainly lends credence to that, but when I do notice is that the weekly chart formed a perfect hammer. Because of this, I would anticipate we may actually break higher, something that might be a little counterintuitive.

There is a lot going on this week, with the Greeks making a decision on whether or not they want to work things out. They will, but as long as there’s any possibility of trouble, people will be a little bit hesitant to own the Euro. On top of that, we have the nonfarm payroll numbers coming out on Friday. I believe that’s probably going to be the real mover. So in the short-term, I am on the sidelines.