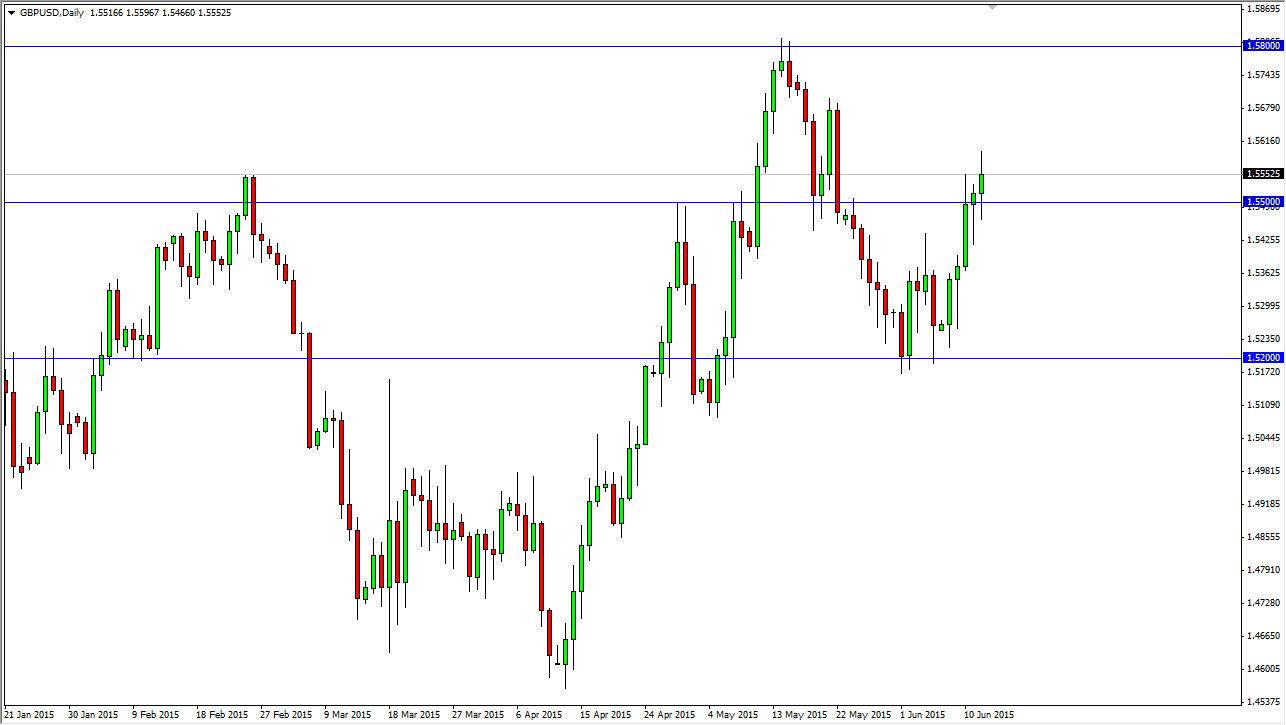

The GBP/USD pair initially fell during the course of the session on Friday, breaking below the 1.55 handle. However, that area offered enough buying pressure to turn things back around and form a relatively positive candle. Quite frankly, the reason I think this is so positive is that we broke above the top of the hammer that formed for Thursday. Breaking the top of that candle is a classic technical analysis signal to start buying, and I believe now we will make an attempt towards the 1.57 level above, and then eventually the 1.58 level which is very important in my opinion.

I believe that once we get above the 1.58 level, the market will continue to be more or less a “buy-and-hold” type of situation, and you also continue to buy on the dips as we grind our way towards the 1.60 level. Ultimately, I don’t really see a scenario in which I want to sell this market, as I see a massive amount of support at the 1.52 level, and then ultimately the 1.51 handle and of course the psychologically significant 1.50 level.

Buying only

I really don’t have a scenario which I want to sell this market unless of course we break down below the 1.50 level, which is a long way from where we are right now. In fact, we are well over 500 pips above that level, so it’s not even a thought. I recognize that short-term pullbacks could be buying opportunities, and will treat them as such. It really comes down to what your comfort level is, but you could be adding to this position every time we pullback and bounce a little bit. If I were to do that though, I would be looking to do it in very small increments as building up over time will be the way to go in my opinion. The longer-term proclivity for this market to go higher should be very profitable if you are patient enough, adding as you go long.