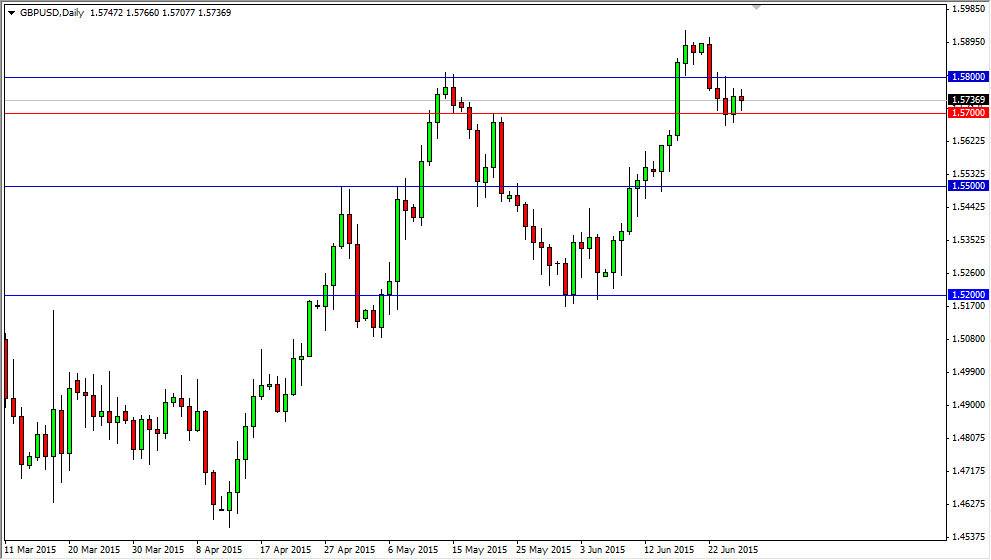

The GBP/USD pair initially fell during the course of the day on Friday but bounced off of the 1.57 level. This level is becoming more and more important, as it represents a bit of a “floor” in this market at the moment. However, I believe that the market continues to go higher regardless of whether or not this area holds, because the true massive support is down at the 1.55 level in my estimation. I also recognize that the British pound broke out recently, and that should not be overlooked. We have simply pulled back looking for support, and it appears that we are in fact finding it. With that, I think it’s only a matter of time before he reach for the 1.58 level and clear it as well.

Long only

I have zero interest whatsoever in selling this currency pair. I think the British pound will continue to strengthen in general, and it looks quite healthy against other currencies around the world. Granted, it may not move as fast against the US dollar as it will against other currencies such as the Australian dollar, but nonetheless this is apparently you have to pay attention to if you are trading the British pound because it is essentially the “measuring stick” that people used to gauge the currency’s strength.

I believe that the British pound had been punished by concerns out of the European Union, as it is so heavily reliant on that market for export. But now things look like they are starting to at least stabilizing Europe for the longer term, and that of course is good for the British pound. I think that the markets got a little bit aggressive thinking that the Federal Reserve was going to start raising interest rates massively. Quite frankly, it appears that they will probably only do one interest-rate hike in the near future, and that’s not enough to justify the British pound being as weak against the US dollar as it has been. With that, I think just like the Euro, the British pound is undervalued.