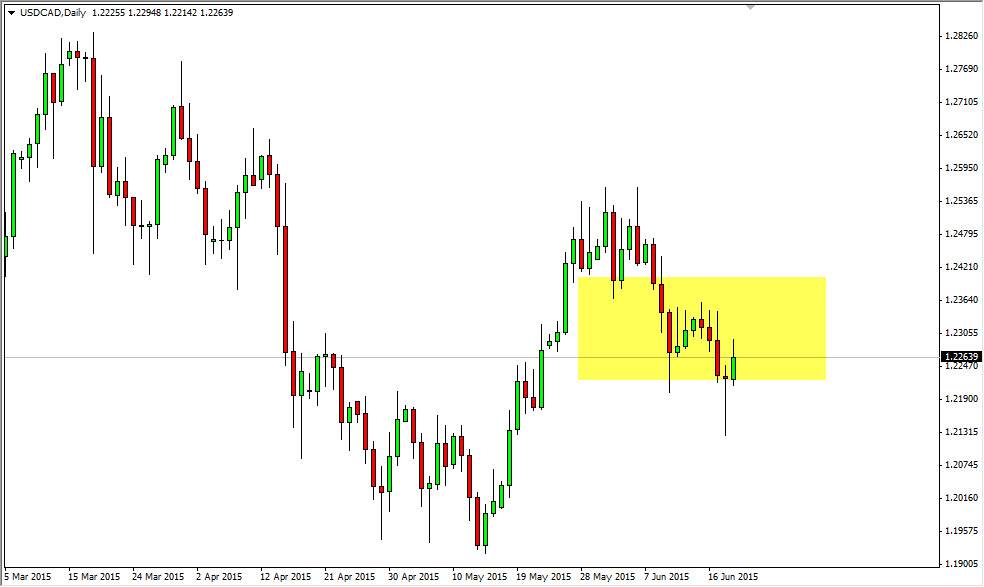

The USD/CAD pair broke higher during the course of the session on Friday, where the top of the hammer that formed on Thursday. That was a short-term buying opportunity, that now looks like the market is heading to the 1.24 level given enough time. However, I recognize that this market is going to continue to chop around, because quite frankly most of the influence in this pair is driving the market in opposite directions.

What I mean by this is that the Federal Reserve looks like it is going to raise interest rates sometime later this year, and that of course is good for the US dollar. On the other side of the equation we have the crude oil markets doing absolutely nothing, which doesn’t exactly make the Canadian dollar move. With that, I think that this market will continue to be very short-term trading oriented, and as a result I feel that it’s difficult to trade this market with any real conviction, but there are short-term trading opportunities that will pop up from time to time.

Continued volatility

I believe that there will be continued volatility in this pair going forward, and quite frankly it is difficult to imagine holding onto a position for anything more than a few dozen pips at a time. However, at this point in time the market should be one that short-term traders flood to and long-term traders will continue to be very frustrated by.

In fact, I’m not even sure what the scenario is I need to see in order to start trading this market from a longer-term perspective. True, the weekly candle is a hammer but there is so much in the way of resistance just above the current level right now, we believe that the market should continue to struggle to go higher. Quite frankly, this is a market that I’m not necessarily interested in trading for anything more than quick grabs of profit. Perhaps using binary options might be the best way to go?