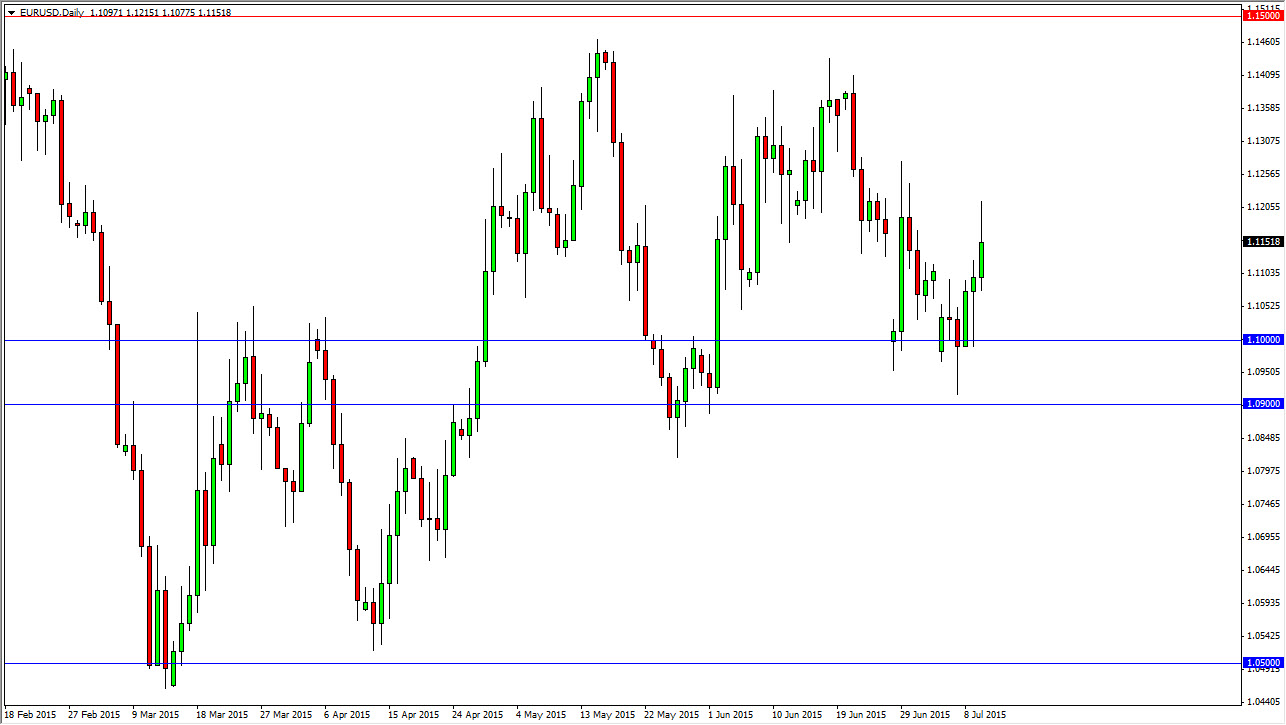

The EUR/USD pair broke higher during the course of the session on Friday, as word got out that perhaps the Greeks were ready to deal with the European Union in favorable terms. With that being the case, I believe that the Euro will continue to find strength every time we pullback, just as we have been finding for the last couple of weeks anyway. I think that it’s only a matter of time before the market breaks out to the upside, so a short-term pullback only offers value as far as I can see in the Euro. After all, the Greeks are rapidly discovering that they are running out of time, and more importantly: options.

With that being the case, I think that the market will eventually get the announcement that it needs, and that perhaps the so-called “smart money” is currently picking up Euros “on the cheap.” Because of this, I think it’s only a matter of time before we finally get an impulsive move in this pair. Recently, we have been grinding away sideways, but if you think about it, from a historical standpoint this is a fairly low valuation when it comes to the Euro.

Buying pullbacks

I continue to buy pullbacks in this pair, and I believe that the longer-term trade should continue to go much higher. With that being the case, I feel that the “smart money” has been adding to their positions again and again every time we pullback. We should see an attempt to break out above the 1.15 level, which in my opinion is the official “starting line” of a new uptrend. If we can get above there, I am more than willing to buy pullbacks going forward there as well, as I will trying to build a massive position in this pair as I feel that we may have seen the absolute bottom.

Keep in mind, Forex markets tend to change trains every 2 to 3 years, and we are about due anyway. It isn't as if the markets are not aware of Greece been a problem, so quite frankly most of the bad news is probably baked in.