USD/CHF Signal Update

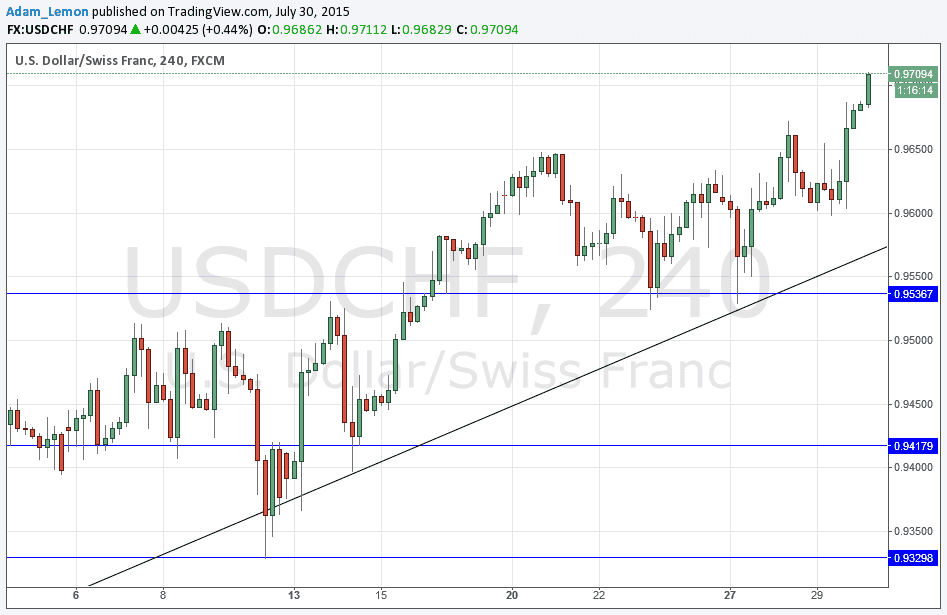

Yesterday’s signals were not triggered as the price never reached the bullish trend line shown in the chart below.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today only.

Long Trade 1

Go long after bullish price action on the 1H time frame following the next touch of the bullish trend line currently sitting at around 0.9570.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Go long after bullish price action on the 1H time frame following the next touch of 0.9537.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

It is interesting how this pair is becoming one of the most USD-bullish. The relatively strong negative interest rate on the CHF seems to be finally succeeding in weakening this currency. We now approach a bullish break out from a 3 month high at 0.9710. For several months since the big price shock in the CHF, this pair has been consolidating with big but decreasing swings, but this big picture pattern seems to now be becoming one of a bullish trend.

In addition to the levels outlined above, there also seems to be local support at the round number of 0.9600.

It is difficult to predict where likely resistance is going to be anywhere close by. It is quite possible that 0.9750 would be a psychological hurdle.

There is nothing due today regarding the CHF. Regarding the USD, there will be a release of Advance GDP, Goods Trade Balance and Unemployment Claims data at 1:30pm London time.