GBP/USD Signals Update

Yesterday’s signals expired without being triggered as none of the key levels were reached during the London session.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today only.

Short Trade 1

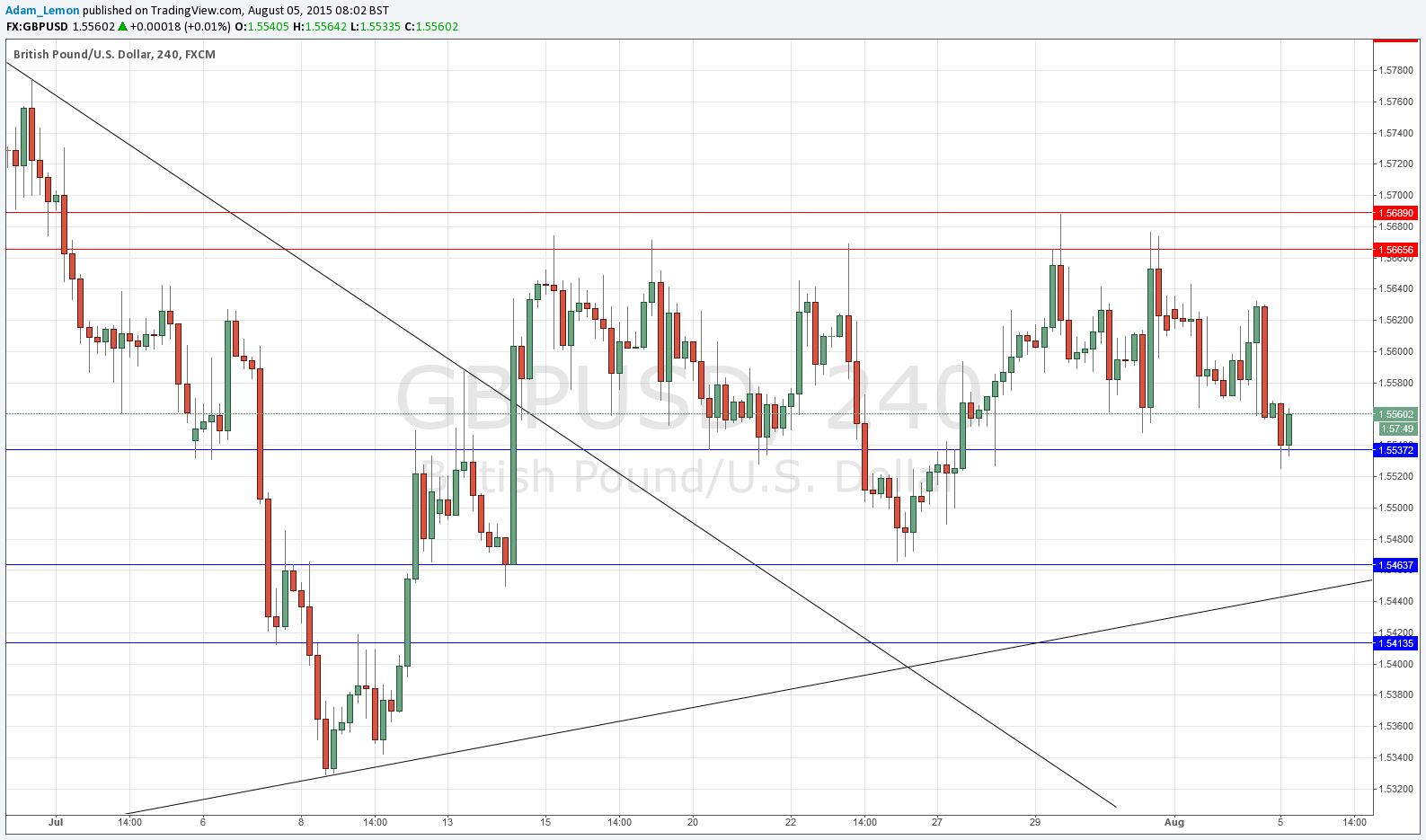

Go short following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 1.5665 and 1.5689.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 1.5605 and leave the remainder of the position to run.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.5537.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 1.5575 and leave the remainder of the position to run.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.5464.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 1.5525 and leave the remainder of the position to run.

GBP/USD Analysis

Not much happened yesterday until after London closed and there were comments appearing from a Fed member suggesting a rate hike in September was probable. This sent the USD up quite quickly during late trading although as the GBP is the second strongest currency after the USD, the short impact was fairly limited. Nevertheless, the price continued to fall during the Asian session and the anticipated support level at 1.5537 held quite nicely. If the USD data disappoints we could see a fairly strong upwards move later to at least 1.5665.

All the key levels remain unchanged.

Concerning the GBP, there will be a release of Services PMI data at 9:30am London time. Regarding the USD, there will be a release of ADP Non-Farm Employment Change data at 1:15pm, followed by the Trade Balance at 1:30pm and ISM Non-Manufacturing PMI at 3pm.