USD/JPY Signal Update

There are no outstanding signals.

Today’s USD/JPY Signals

Risk 0.50%

Trades may only be taken between 8am and 5pm New York time only, and then after 8am Tokyo time later.

Long Trade 1

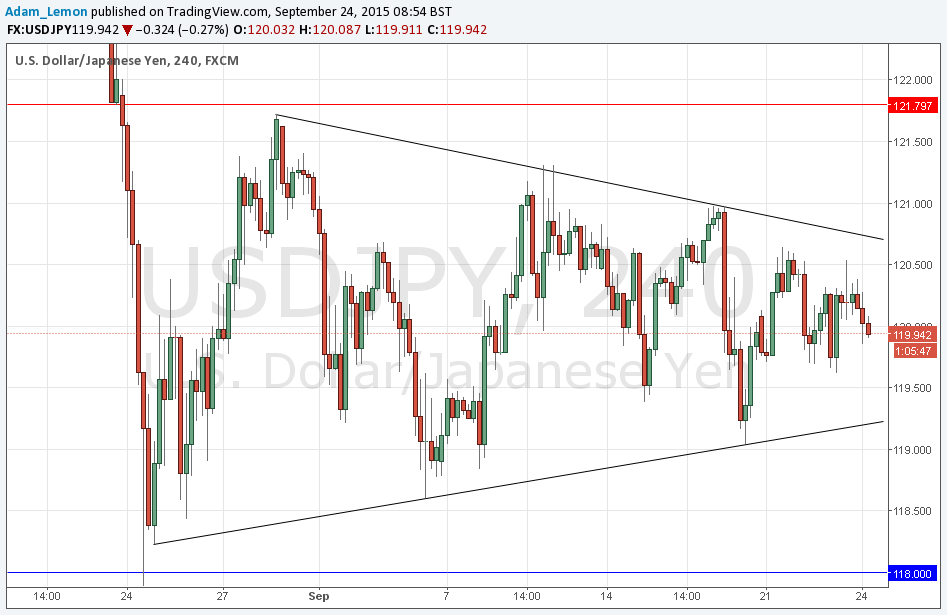

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the bullish trend line currently sitting at around 119.21.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of the bearish trend line currently sitting at around 120.70.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run

USD/JPY Analysis

The chart below shows that this pair is in the middle of a very strong, quite long-term narrowing triangular consolidation. This is a very typical situation for this pair to be in, as it loves to consolidate into narrowing triangles. The current consolidation between 118.00 and 121.75 has been going on for about a month.

Good results have historically been achieved in this pair by trading breakouts of these consolidating triangles.

In the meantime, the best bet is usually to fade touches of the trend lines, and that is what I am currently looking for here.

There is nothing due today regarding the JPY. Concerning the USD, there will be a release of Core Durable Goods Orders and Unemployment Claims at 1:30pm London time. The Chair of the Federal Reserve will be speaking at 10pm.