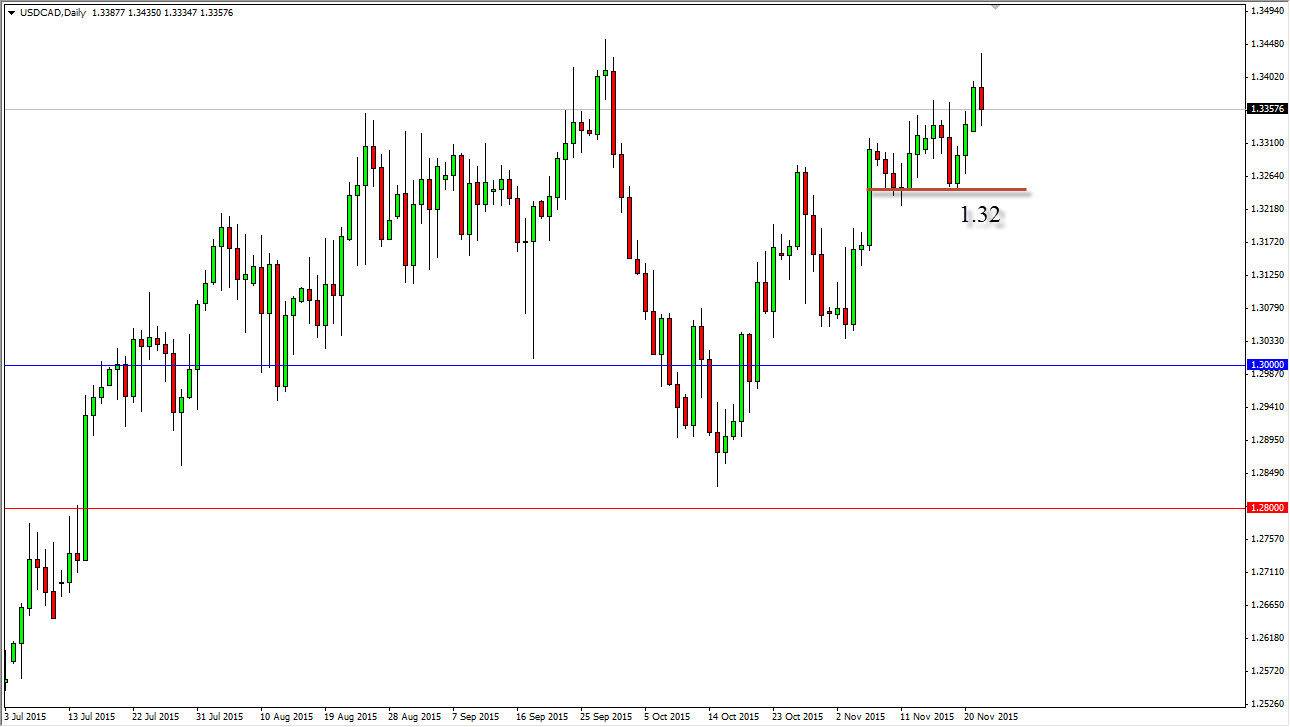

The USD/CAD pair went back and forth during the day on Monday, struggling as we reached towards the 1.3450 level. That’s an area that I suspect should be resistive, and I think that resistance runs all the way to the 1.35 handle. The 1.35 handle of course will offer a bit of resistance based upon the large, round, psychological significance of the number, so with this I feel that the market is more than likely going to fall from here. I think if we can either find a short-term resistive candle or a break down below the bottom of the range for the day, this market will more than likely reach back towards the 1.32 handle given enough time.

However, I have no interest in selling this market. I think that short-term traders may be able to do so, but ultimately the 1.32 level below should be massively supportive yet again. It’s been pretty supportive the last couple of weeks, so I feel that it’s only a matter of time before the buyers get involved again.

Oil Markets

Oil markets are far too soft to support the Canadian dollar for any real length of time in my opinion, and as a result this is a bit of a one-way trade at the moment. It is true, oil is starting to show signs of support in that general vicinity that we find yourselves and, but this is more or less a bit of a “dead cat bounce” in a market that has been falling apart for some time. With this, I believe that this short-term bounce is going to be a simple opportunity to start shorting oil again, which of course translates into a stronger Canadian dollar. This is especially true when you are measuring it against the US dollar, as it is the strongest currency in the world at the moment. With this, I think it’s only a matter of time before he break above 1.35, but it might take a couple of attempts.