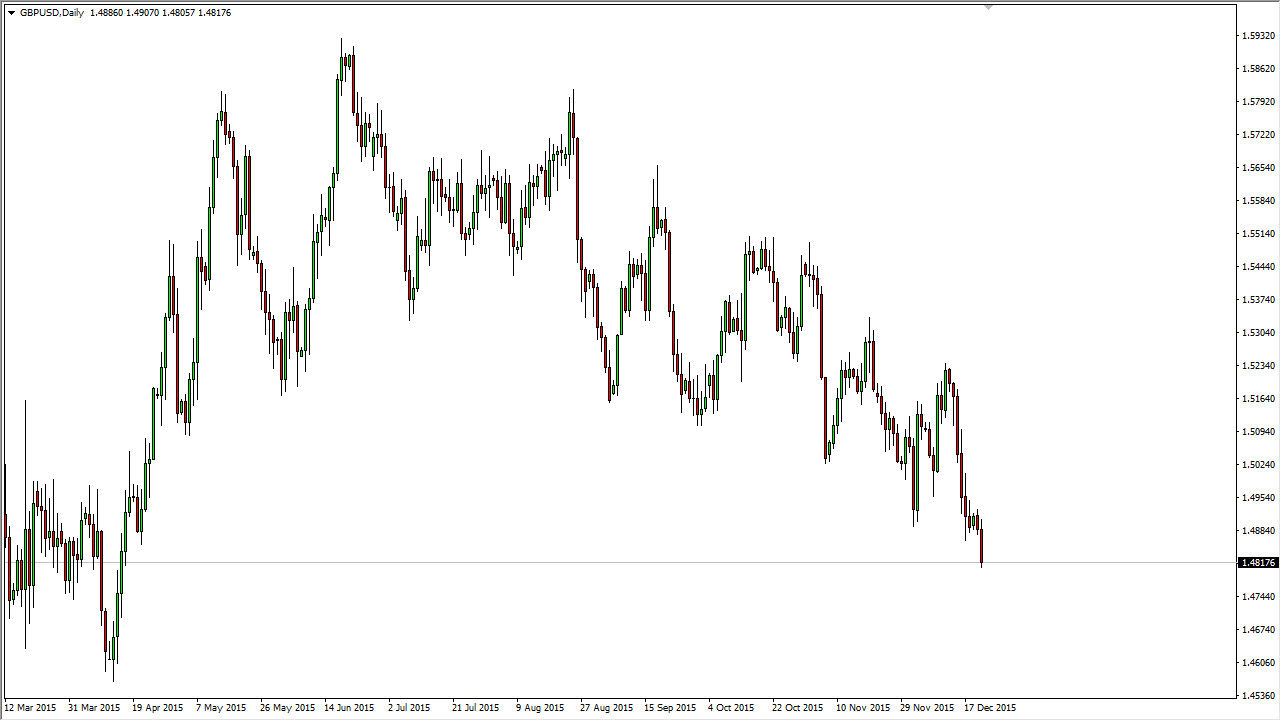

The GBP/USD pair fell again during the session on Tuesday, as we tested the 1.48 level. The market continues to look very soft in general, and as a result we are sellers of short-term rallies that show signs of exhaustion. Ultimately, a resistive candle is what I’m looking for in order to start selling. I think that the 1.49 level above should be a bit resistive, and the fact that we are just in front of the Christmas holiday tells me that we should probably see most of the trading off of short-term charts. After all, it’s hard to imagine a situation where we would want to hang onto a trade for any real length of time right now. The volume simply isn’t even there, and with that I find it difficult to imagine that a move is about to happen.

I Favor the US Dollar Anyway

I favor the US dollar in general anyway, simply because the concern around the world continues. The economic situation is simply not stable enough for traders to feel comfortable buying anything else but the US dollar or bonds for any significant amount of time as far as I can see, so having said that I feel it’s only a matter of time before the US dollar continues to attract buyers.

The trend is most certainly to the downside, and I believe that we go down to the 1.45 handle, as it is a massive supportive level on the longer-term chart. I think that it is not until we get above the 1.51 level that we have to think that perhaps the longer-term trend is trying to change. Having said that, the British pound does look a bit soft against other currencies as well, so at this point in time I feel that selling rallies will be the only way to go. While we may get a turnaround eventually, between now and the beginning of the year is highly unlikely.