By: DailyForex.com

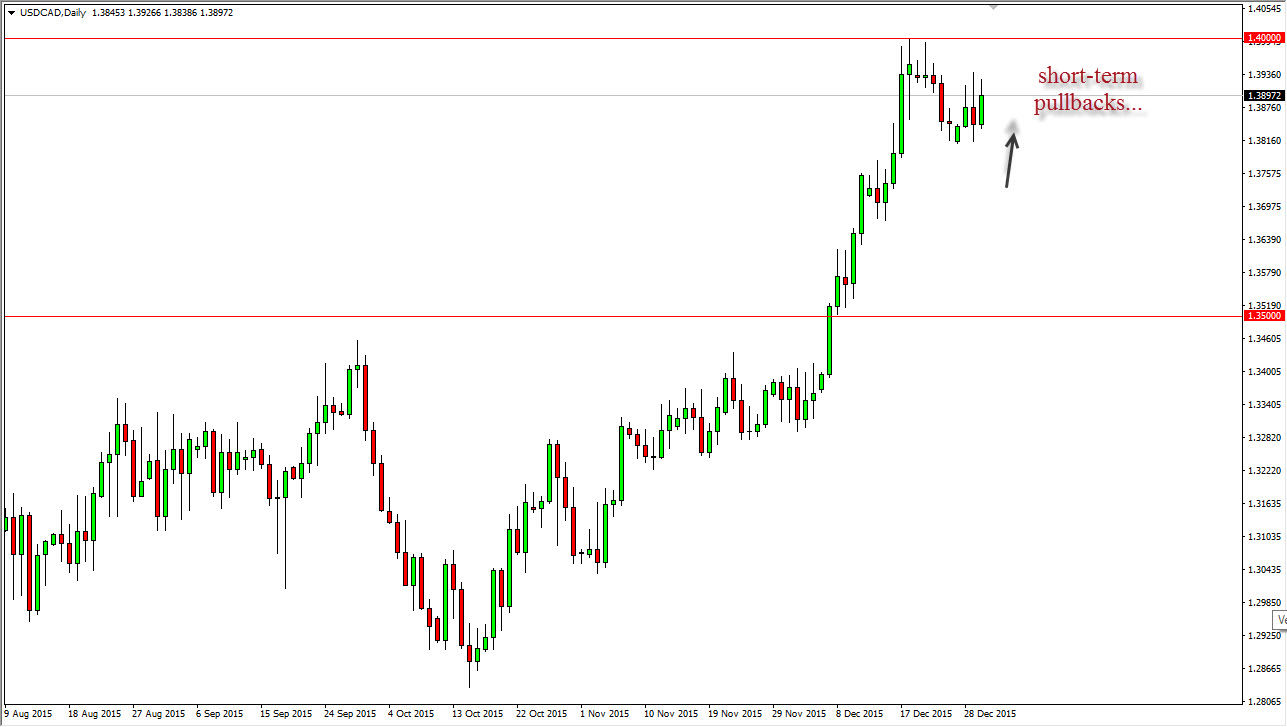

For those of you who read my analysis, you know that I am very bullish of this particular pair. After all, the USD/CAD pair has been rallying for some time, and we did recently break above the 1.30 level which for me was essentially the end of the downtrend. With that being the case, I feel that it’s only a matter of time before we continue to go higher every time we pullback.

The US Dollar is currently one of the strongest currencies in the world, so that of course means that there is already a certain amount of bullishness built into this particular market. On top of that, the Canadian Dollar itself has been struggling against almost everything out there. This is of course due to the fact that the Canadian dollar so highly leveraged to the petroleum markets, which of course have struggled.

Buying Pullbacks

I believe in buying pullbacks in this particular market, and short-term charts should lead the way as we of course will have a bit of concern when it comes to the liquidity, so I believe that larger moves are very unlikely. I think that simply waiting for the market to pull back on short-term charts and trying to take 40 or 50 pips out at a time over the next several sessions will be the way forward. However, I recognize that longer-term trades should present themselves fairly soon.

Obviously, a break above the psychologically significant 1.40 level is a very bullish sign and I believe at that point in time we would have to start thinking about long-term “buy-and-hold” type of trade yet again. This should coincide with a breakdown in the oil markets, which looks like it’s very likely to happen fairly soon. Pullbacks around here should have plenty of bullish pressure underneath in order to start buying yet again. I believe that the 1.35 level is essentially the “floor” in this market, so selling isn’t even a thought.