USD/CHF Signal Update

Last Thursday’s signals expired without being triggered.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm London time today.

Long Trade 1

* Long entry at 9am London time if the price is at 0.9830 or above but below 0.9850.

* Put the stop loss at 0.9797.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

* Long entry after bullish price action on the H1 time frame following a first touch of 0.9739.

* Put the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Short entry after bearish price action on the H1 time frame following a touch of 0.9900.

* Put the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

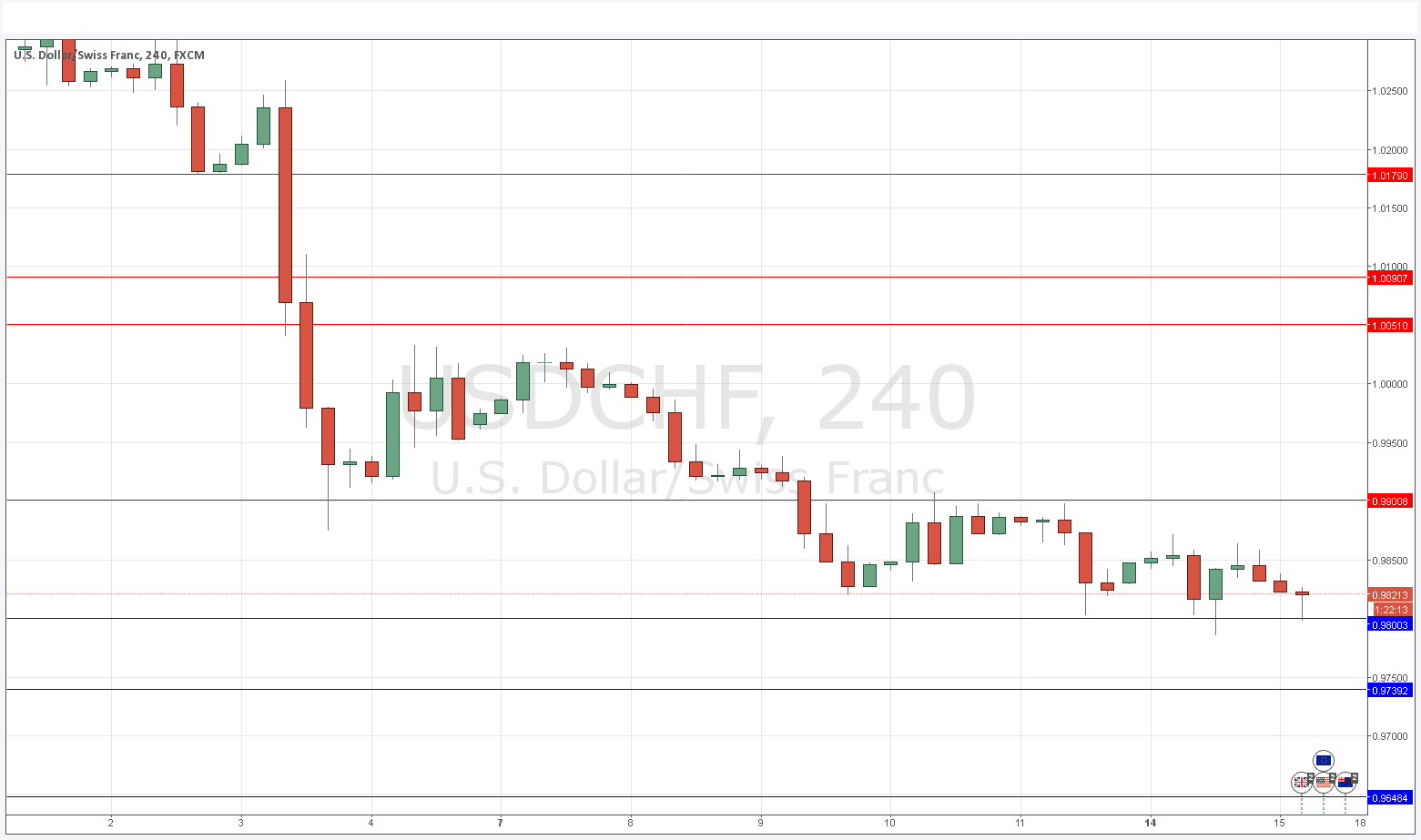

USD/CHF Analysis

This pair continues to move in sync with EUR/USD these.

However it seems there is an opportunity close by as the pair has become stuck between 0.9800 and 0.9900 after a meaningful downwards move. If there is USD strength now and 0.9800 holds, there could be a major move up from here, especially if as expected the Federal Reserve raised the US interest rate tomorrow.

The long side looks more attractive for a long-term trade than the short side, even though there is also another level with good resistance close by at 0.9900.

There is nothing due today regarding the CHF. Concerning the USD, there will be a release of CPI data at 1:30pm London time.