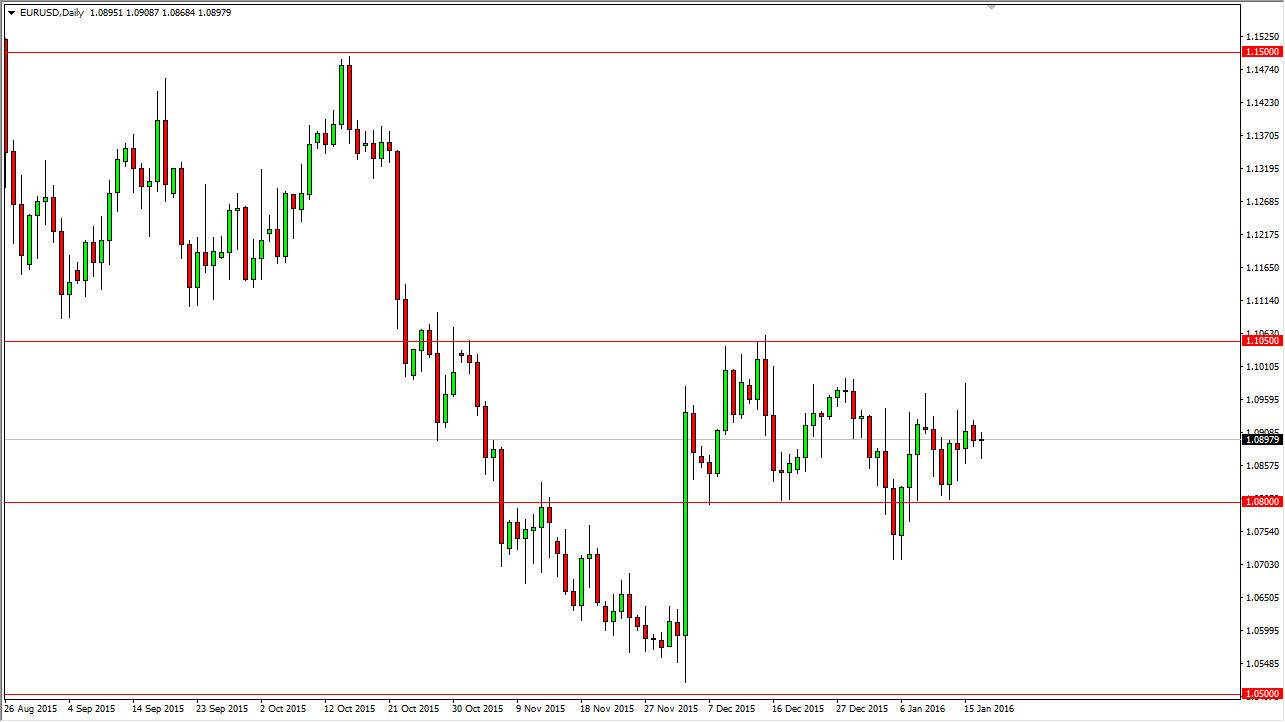

EUR/USD

The EUR/USD pair fell during the session initially on Monday, but bounced enough to form a neutral candle. Quite frankly, this is a great place to get chopped up in the marketplace right now. I can make an argument for either direction, and I can also say that you will run into trouble no matter which direction you pack. This is because there’s a lot of choppiness in this general vicinity, and even though we formed a somewhat supportive candle for the Monday session, you cannot ignore the couple of shooting stars that formed last week. Because of this, I feel that the market is probably best left alone at this point in time.

We do have German ZEW Economic Sentiment numbers coming out today, and that could have an effect on the market but quite frankly I don’t think it will. I believe that this market will continue to be very choppy but does seem to have a slightly negative bias due to the lower highs that had formed recently.

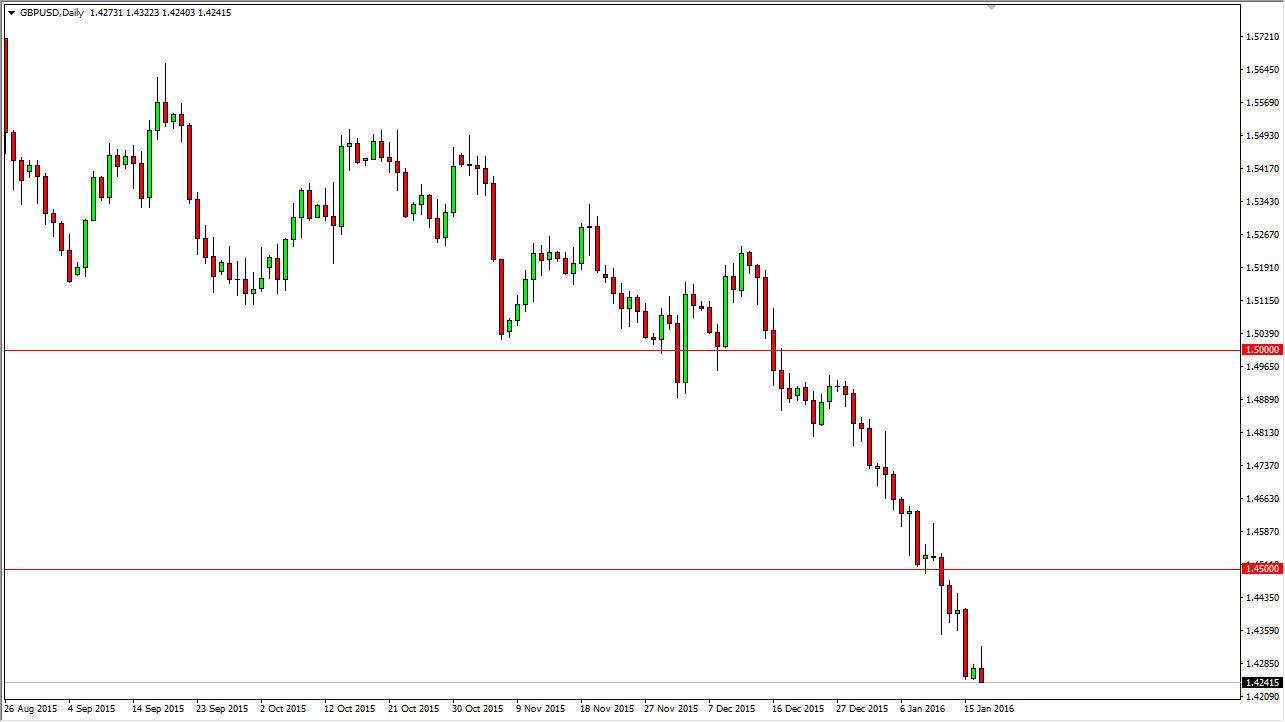

GBP/USD

While the Euro is hard to discern as far as a trading stance, the British pound is not. You can see that we tried to rally during the early part of the Monday session, but ended up turning around and forming a rather significant shooting star. The shooting star at the bottom of the downtrend normally means consolidation and shows an extraordinarily weak market. If we continue below, I think we will reach the 1.40 level fairly soon. In fact, at this point in time that is my longer-term target.

I recognize that a break above the top the shooting star would be extraordinarily bullish, but I think there is significant resistance at the 1.45 level. Quite frankly, if we break out to the upside I am more than willing to simply wait for a selling opportunity at higher levels.