NZD/USD Signal Update

Yesterday’s signals were not triggered as there was no bullish price action at 0.6390.

Today’s NZD/USD Signals

Risk 0.75%

Trades must be taken between 8am New York time and 5pm Tokyo time today.

Long Trade 1

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6298.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.6390.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.6500.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

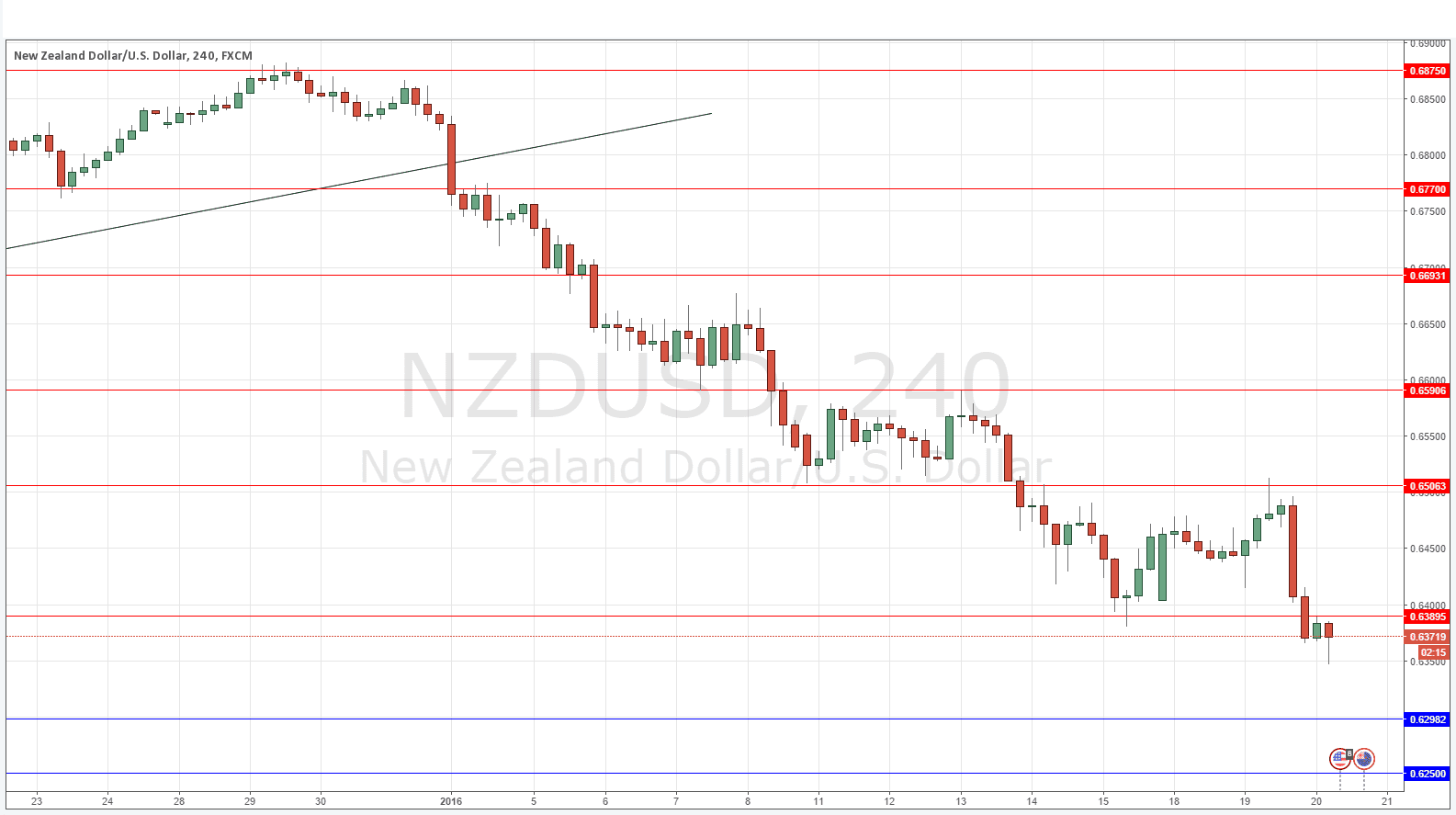

NZD/USD Analysis

This pair fell with some momentum overnight as the USD strengthened and there was also a release of poorer than expected New Zealand economic data. The anticipated support level at 0.6390 was broken late in the previous Asian session and may now begin acting as resistance. If the price holds below there until the New York open later today and then rejects the level again, it could be a good short trade entry.

There is support below confluent with the round number at 0.6300 and also half a handle below that there is 0.6250 which is a key psychological level.

Concerning the USD, there will be releases of Building Permits and CPI data at 1:30pm London time, followed later by Crude Oil Inventories at 3:30pm. There is nothing due regarding the NZD.