USD/CAD Signal Update

Yesterday’s signals were not triggered and expired.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be entered before 5pm New York time today.

Long Trade 1

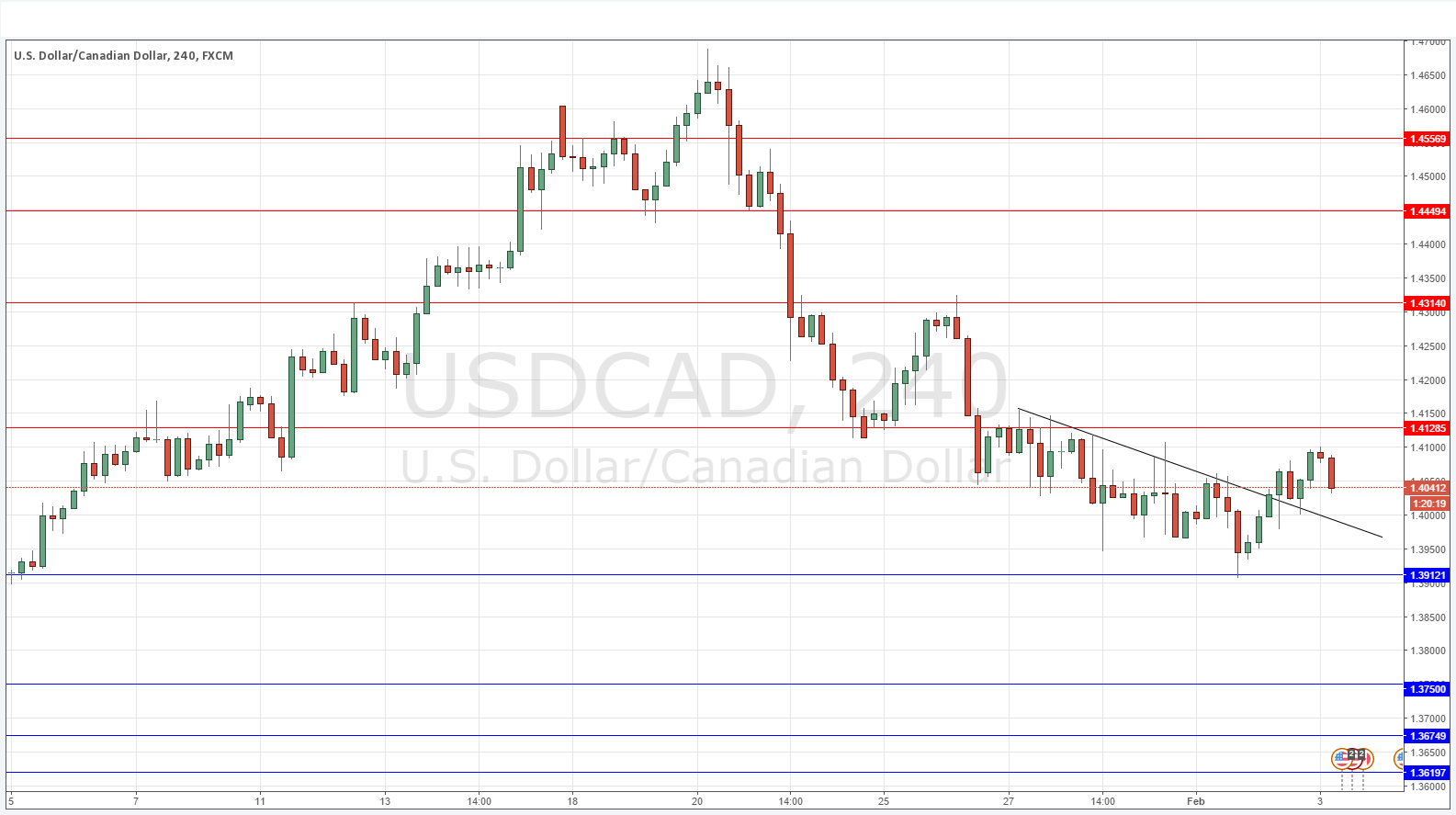

* Go long following a bullish price reversal on the H1 time frame upon the next touch of 1.3912.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short after bearish price action on the H1 time frame following a touch of 1.4128.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CAD Analysis

We have had a key development in that this pair is finally looking as if it might have found some support, breaking up past the short-term bearish trend line although it is now falling again. However if it makes another obvious low above 1.3912 – or ideally, above the broken trend line – and then starts to go up again, the prospects for a long trade start to look interesting. This is because despite the recent strengthening of the CAD and Crude Oil, there is usually a strong bounce back in the direction of such a strong trend, so there might be at least a few hundred long pips on the way to watch out for.

Alternatively, the bearish movement may reassert itself if the price cannot break up above 1.4128.

There is nothing due today concerning the CAD. Regarding the USD, there will be a release of the ADP Non-Farm Employment Change at 1:15pm London time, followed later by ISM Non-Manufacturing PMI at 3pm and Crude Oil Inventories at 3:30pm.