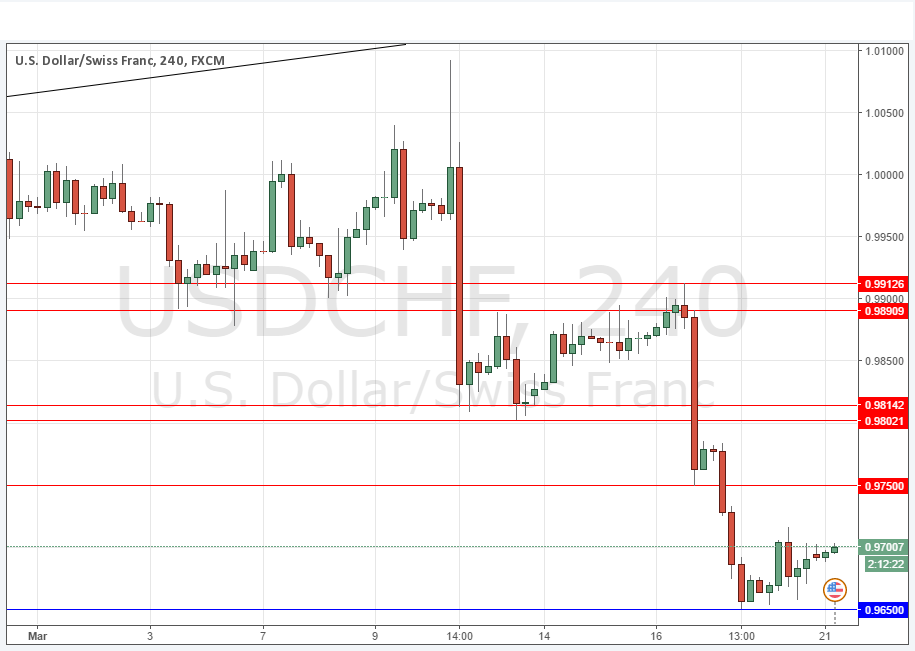

USD/CHF Signal Update

Last Thursday’s signals did not produce the correct bullish price action on the H1 chart to trigger a long trade following the rejection of 0.9650, but this anticipated support held to the pip.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today only.

Long Trade 1

* Go long after bullish price action on the H1 time frame following the next touch of 0.9650.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Short entry after bearish price action on the H1 time frame following the next touch of 0.9750.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

* Short entry after bearish price action on the H1 time frame following the next entry into the zone between 0.9802 and 0.9814.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

I wrote last Thursday “as always with this pair, support and resistance at round numbers seems to remain very reliable.” We can add half numbers to the round numbers as 0.9650 held well practically to the pip, and we also have an obvious resistant inflection level above at 0.9750 that looks very likely to produce something if and when it is retested from below.

This pair is certainly in a medium-term downwards trend as the USD has weakened, but it is not fully bearish quite yet, we really need to see the price getting established below 0.9750 for a week or so before that happens.

There is nothing due today concerning either the CHF or the USD.