USD/CHF Signal Update

Yesterday’s signals were not triggered.

Today’s USD/CHF Signals

Risk 0.50% per trade.

Trades may only be taken between 8am and 5pm London time today.

Long Trade 1

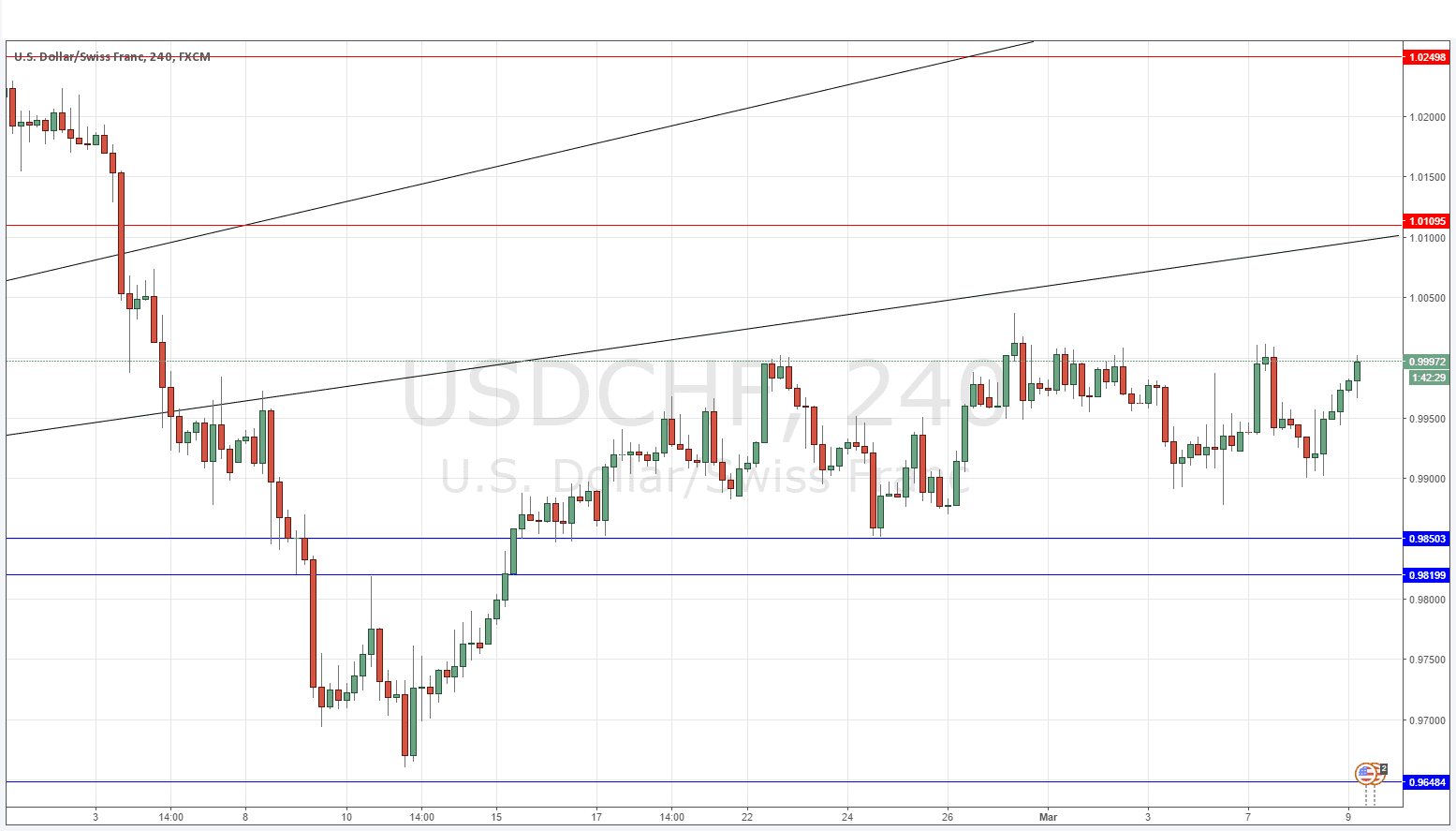

* Go long after bullish price action on the H1 time frame following the next entry into the zone between 0.9850 and 0.9820.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Go short after bearish price action on the H1 time frame following the next touch of the trend line currently sitting at around 1.0195.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

As expected, there was some support at around 0.9900 yesterday, and the price has been rising from that level since with some conviction. At the time of writing, the price is just testing 1.0000 which has been acting as resistance. It is starting to look as if the level may be broken this time, which would suggest that the next move is a push up to the broken trend line just below the horizontal resistance level at 1.0110.

There is nothing due today concerning the CHF. Regarding the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time.