AUD/USD Signal Update

Yesterday’s signals were triggered following a bullish inside bar rejecting the support level at 0.7569. Partial profits should already be taken.

Today’s AUD/USD Signals

Risk 0.75%

Trades may be taken between 8am New York time and 5pm Tokyo time only.

Long Trades

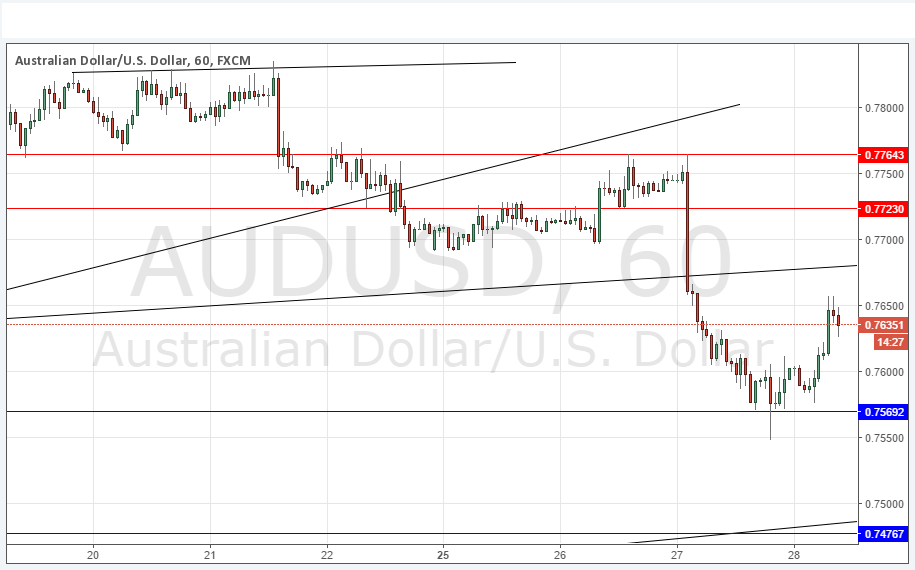

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7569 or 0.7467.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7723 or 0.7764.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

AUD/USD Analysis

Bulls will be encouraged by the renewal of USD weakness following yesterday’s FOMC Statement, and the U-shaped bottom formed by price action at 0.7569. However although this pair is in a long-term upwards trend, there is a big question over whether the price is really going to get any higher in the near future. The big test will be whether the price can really get established above 0.7700 or not.

Regarding the USD, there will be releases of Advance GDP and Unemployment Claims data at 1:30pm London time. There is nothing due concerning the AUD.