Oil prices were collapsing earlier this year, but they’ve since rebounded nearly 60% from their February lows. Is the price going to keep rising?

Personally, I don’t think so. I think the price is likely to fall back down towards the recent lows, although probably not that low again.

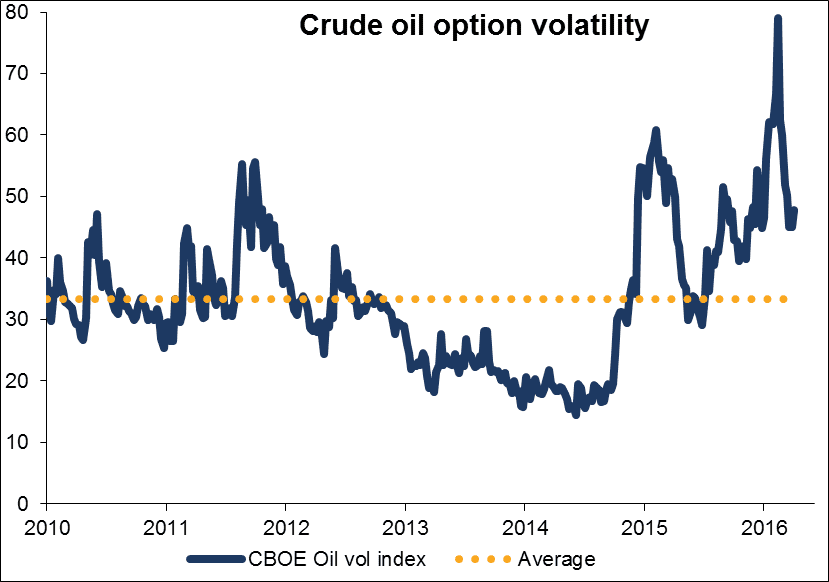

But in any case, I expect the oil price to remain quite volatile as economics, technology, geopolitics and finance combine to provide an unstable supply and demand picture for crude.

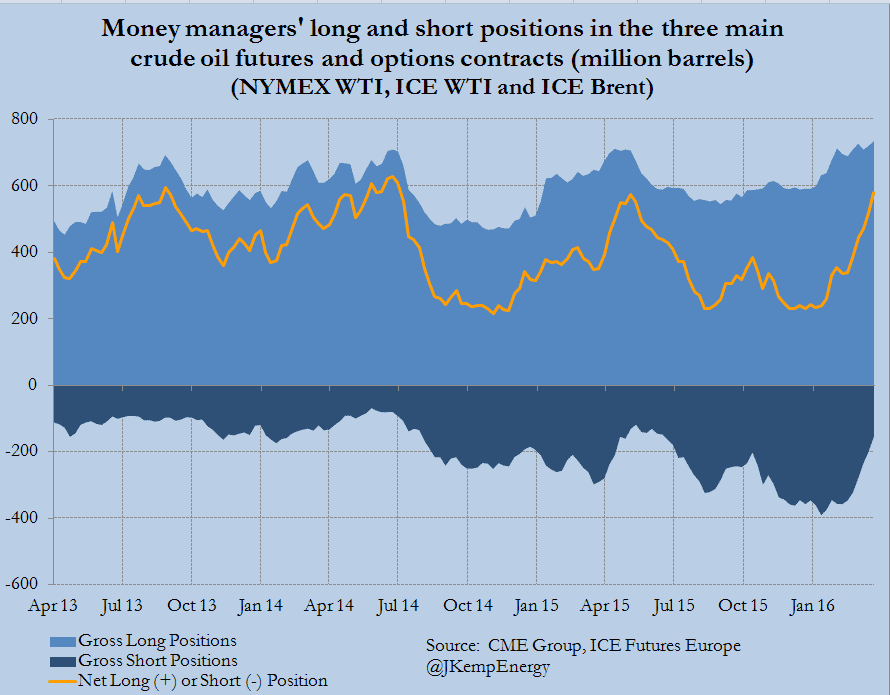

Behind the recent rally has been a remarkable turnaround in speculative positions. So far this year, hedge funds and other investors have more than doubled their net long position in oil futures and options. It’s now approaching the record set in June 2014, when it looked like ISIS fighters might take over Iraq.

As you can see, not only were investors accumulating long positions, but they also closed out over half of the record short positions that they held. It was this short-covering really that pushed oil prices up.

The question is, what will cause investors to continue to close out these short positions or to buy more contracts? This is where it gets difficult.

True, there has been some decline in global production. That’s because of several disruptions to supply, such as malfunctions at a Venezuelan export terminal and a pipeline bombing in Nigeria. And there’s been some hope that OPEC and the major non-OPEC countries would agree at their meeting in Doha on April 17th to at least freeze production, if not cut it back.

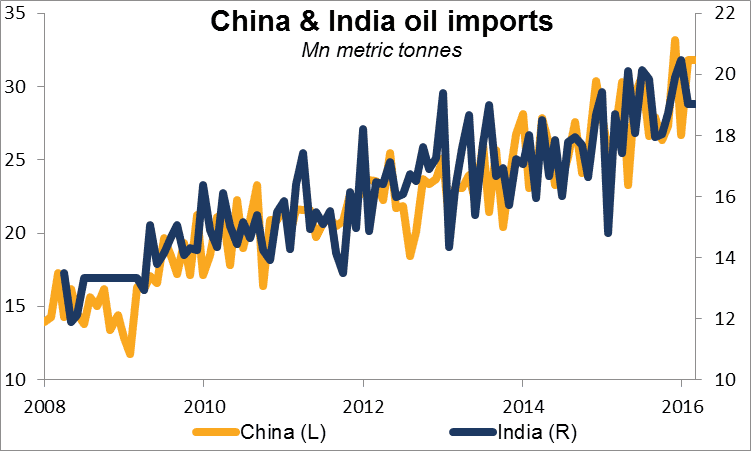

At the same time, demand out of China and India has been strong, with both countries importing near record amounts of crude and products in February.

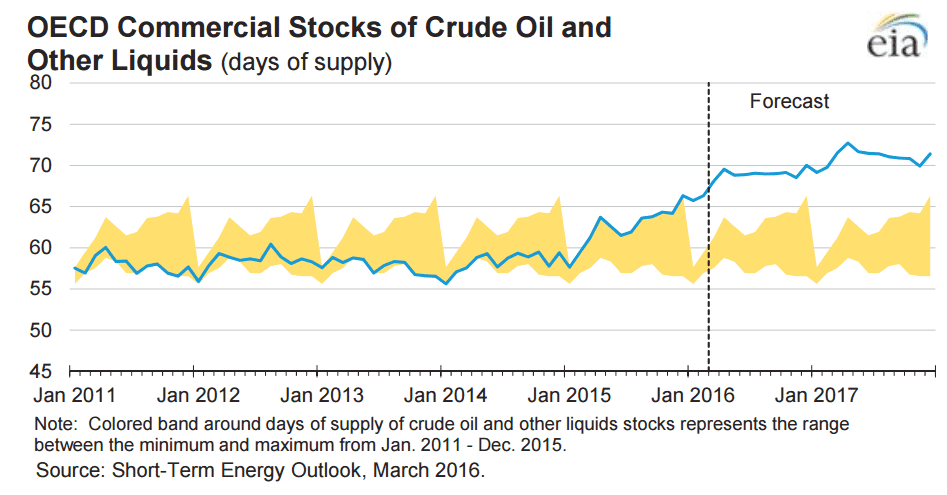

But there’s one big problem overhanging the market: the global inventory overhang. The whole world could stop pumping oil for a week and that would only bring inventories back to their normal level. And we all know that’s just not going to happen. On the contrary, the US Government’s Energy Information Administration expects that global inventories will continue to rise this year and even next year.

Aside from supply and demand, there’s another factor coming into play: the refinancing of America’s shale oil producers. As I mentioned, the oil market is the intersection of economics, technology, geopolitics and finance. Economics determines the demand for oil. Technology increases oil companies’ ability to find and develop oil reserves. Geopolitics can interrupt oil supplies, as it is now in Nigeria, or increase supplies, like with Iran.

The impact of finance is a bit less obvious. It’s most important with the US shale oil companies, which depend on bank loans for finance. Banks reset oil companies’ credit facilities twice a year. They determine how much the companies can borrow based on the value of the companies’ oil reserves. If the price of oil is high, the banks lend them more money; if the price is low, the banks cut back their loans. Many of these agreements are coming up for renewal in April. If oil prices fall further, then much of the US shale oil production may be shut down, causing a big spike up in prices. And if the loans get rolled over, then production can continue unabated, which might push prices down.

So there’s a lot that might move the price of oil in the near future: speculative positioning, the Doha meeting, Asian demand, US shale oil refinancing…The direction of prices isn’t clear by any means.

But what is clear is that the volatility of oil is likely to remain high as these many cross-currents intersect to push the price around. That’s why I think oil is an attractive market for investors looking for volatility.