USD/JPY

The USD/JPY pair broke down during the course of the session on Friday, breaking down below the bottom of the hammer from the Thursday session. This of course is a very negative sign, and as a result I believe that the USD/JPY will continue to break down from here, reaching towards the 107.50 level again. I do think that we break down below there and try to reach towards the 105 level, but I also recognize that we will see quite a bit of volatility between here and there. I believe that the 110 level above is a significant amount of resistance just waiting to happen, and on top of that I believe that the resistance extends all the way to the 111 level. In other words, I think this is a “sell only” market right now.

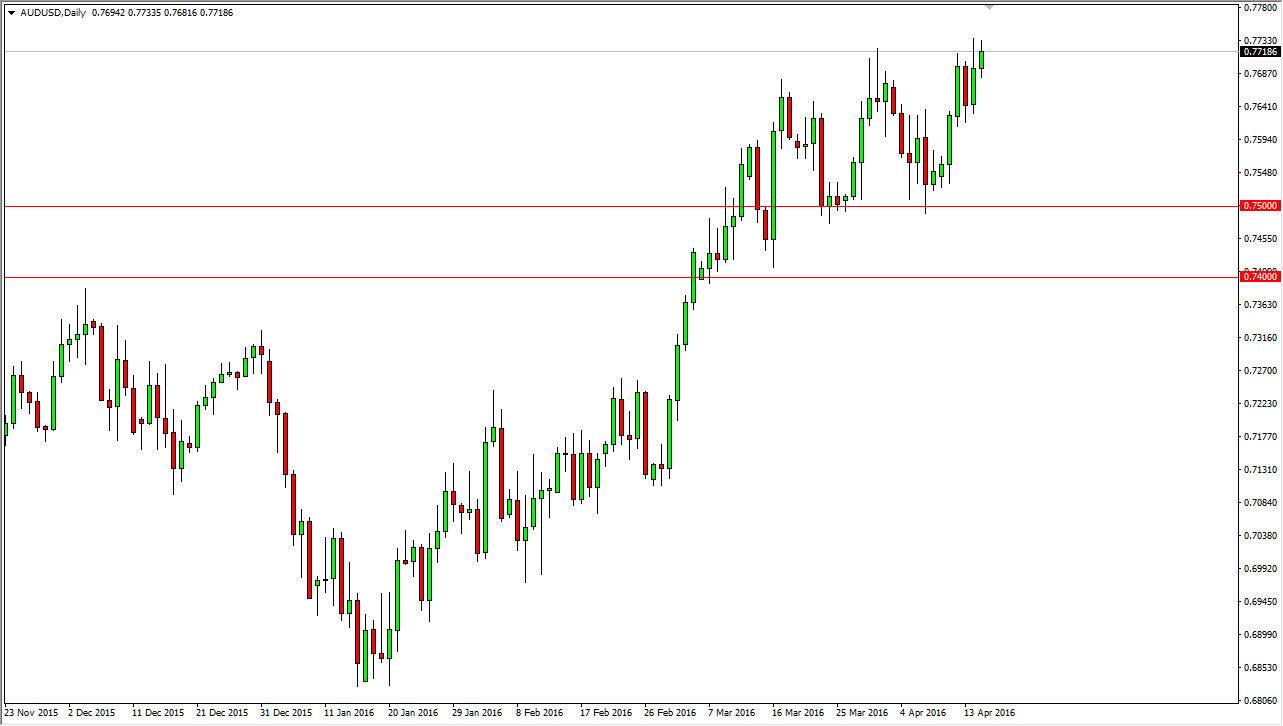

AUD/USD

The AUD/USD pair broke higher during the course of the session on Friday, as we continue to break above the 0.77 handle. Given enough time, we should continue much higher, perhaps to the 0.80 level. This is a major level on longer-term charts, so therefore it should cause quite a bit of interest. At this point in time, I believe that the market will pull back from time to time, but that should be thought of as “value” in the Australian dollar, as we are most certainly in a very bullish trend at the moment. Pay attention to gold, it’s quite frankly one of the biggest movers of the Australian dollar, as it tends to rise right along with the value of gold.

Looking at this market, I see quite a bit of support near the 0.75 level, and as a result any pullback at this point in time will more than likely find buyers between here and there. On top of that, if we break down below the 0.75 level, I feel that there is enough support all the way down to the 0.74 handle. A supportive candle in that range is more than enough reason to start buying. I also buy on a break of the top of the range for the Friday session.