USD/CHF Signal Update

Yesterday’s signals were not triggered.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today only.

Long Trade 1

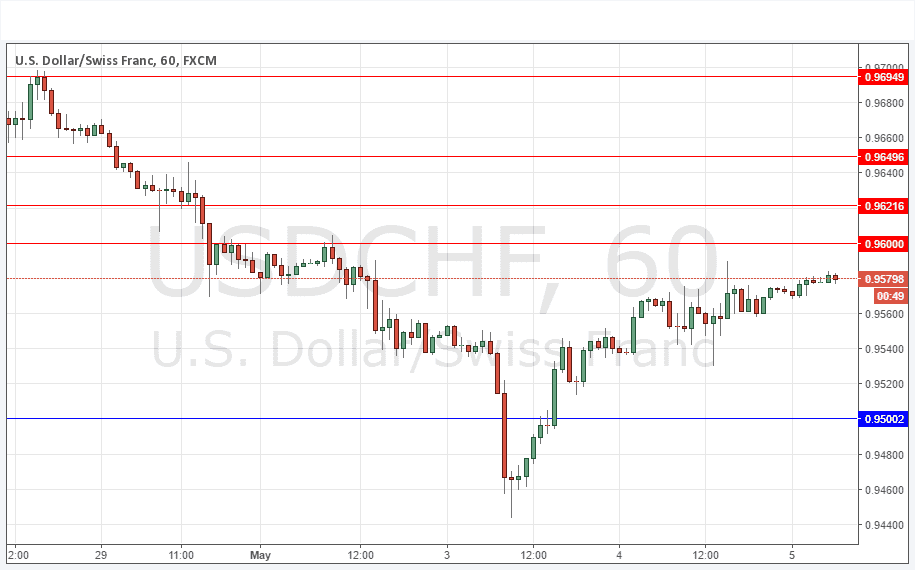

Go long after bullish price action on the H1 time frame following the next touch of 0.9500.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short after bearish price action on the H1 time frame following the next touch of 0.9600, 0.9622 or 0.9650.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

It is beginning to look as though the upwards move might run out of steam. We are not far from a key resistance level which is also a round number, at 0.9600. Round number resistance has been very effective in trading this pair recently, so a bearish reversal there could be an excellent chance for the long-term bearish trend to reassert itself, and for a short entry to be sought.

There is likely to be minor support at 0.9550.

There are no high-impact events due today concerning the CHF, it is a public holiday in Switzerland. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time.