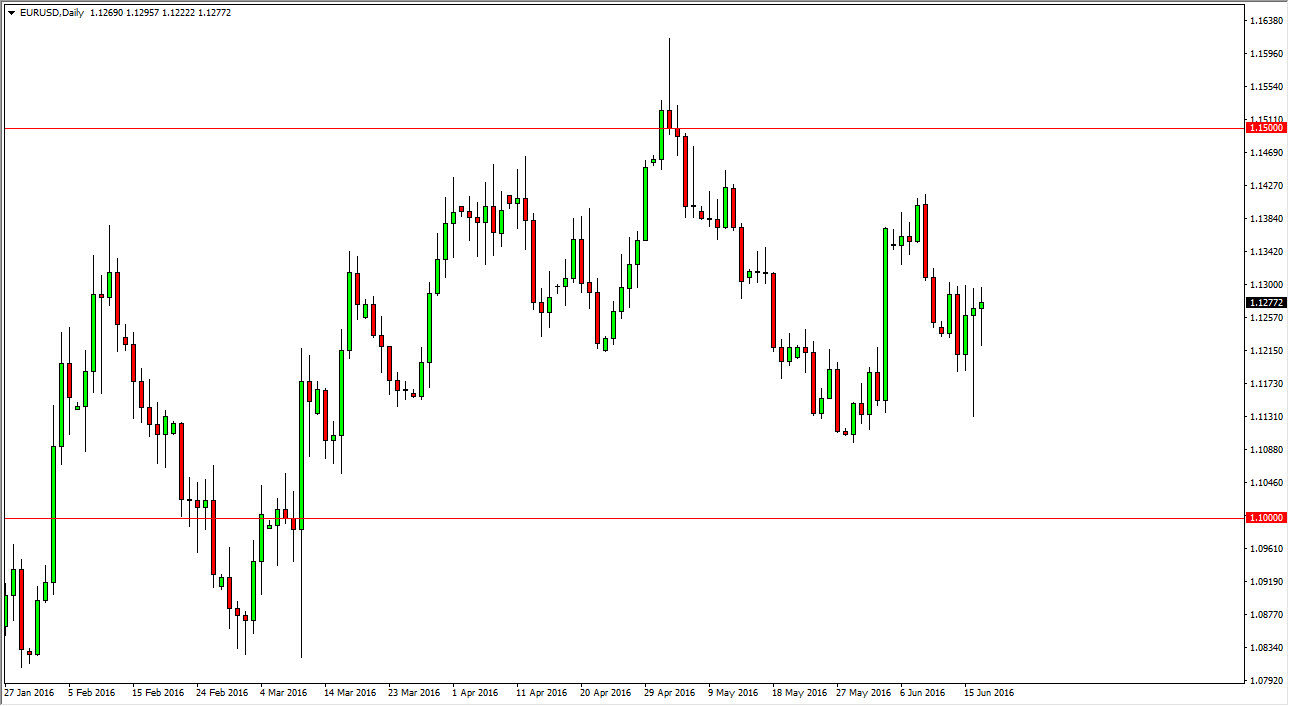

EUR/USD

The EUR/USD pair initially fell during the day on Friday, but turned right back around to form a bit of a hammer. The hammer that formed during the session on Thursday was very bullish as well, so if we can break above the top of the candles from the last several sessions, I believe that the market could make a move towards the 1.14 level. At this point, short-term pullbacks might be buying opportunities for short-term traders. I’m not looking for a big move yet though; I believe that this market is essentially grinding sideways as we wait to find out what the British do about the EU referendum. This of course will cause quite a bit of concern as to the future of the EU itself, so therefore it is reflected in the currency.

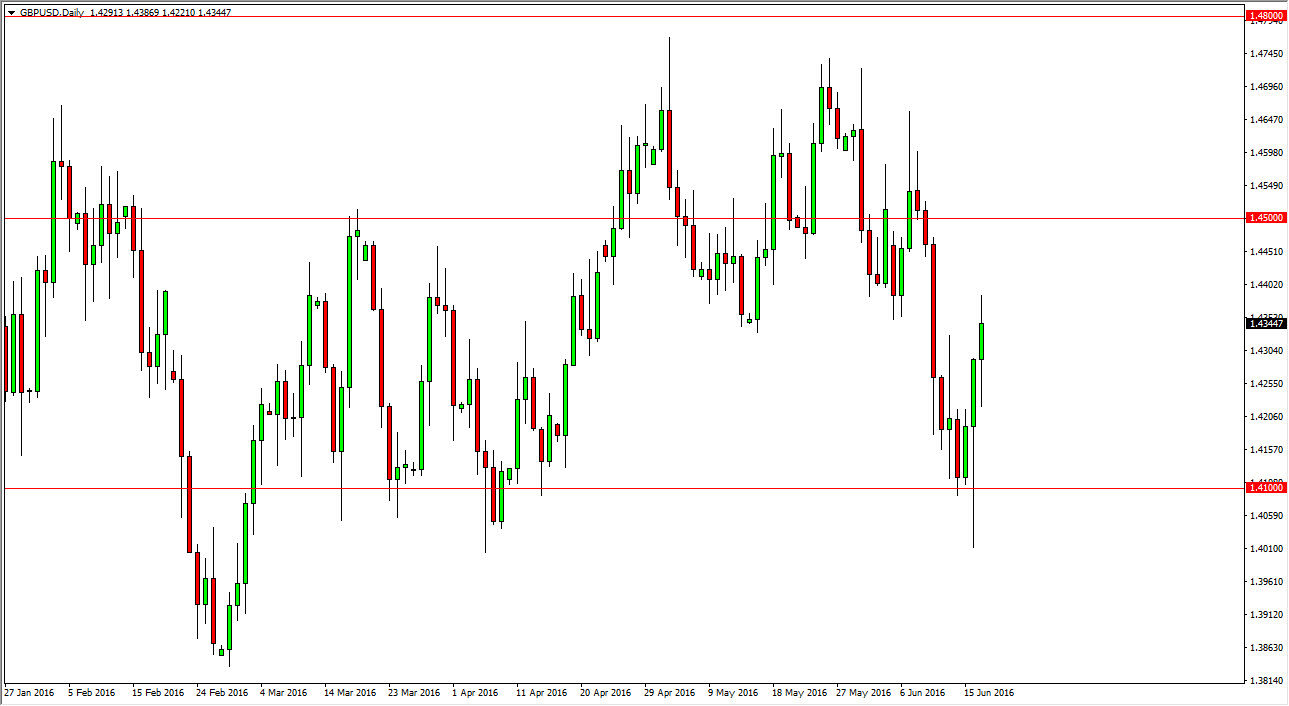

GBP/USD

The GBP/USD pair initially fell during the course of the session on Friday, but turned right back around in order to form a bullish candle. A break above the top of the range during the course of the session on Friday would of course be a reason to send this market higher, and perhaps reaching towards the 1.45 level. The area above there will more than likely be very resistive though, and you have to keep in mind that the British will be voting on whether or not they are going to stay in the European Union. That keeps quite a bit of pressure on the British pound in general, but at the same time we also have to worry about the Federal Reserve and whether or not they can raise interest rates anytime soon. Essentially, we have to deal with quite a bit of volatility, and therefore it’s a market that will continue to be very difficult to deal with. Ultimately, this is a market that probably won’t make much sense until we get an actual vote.