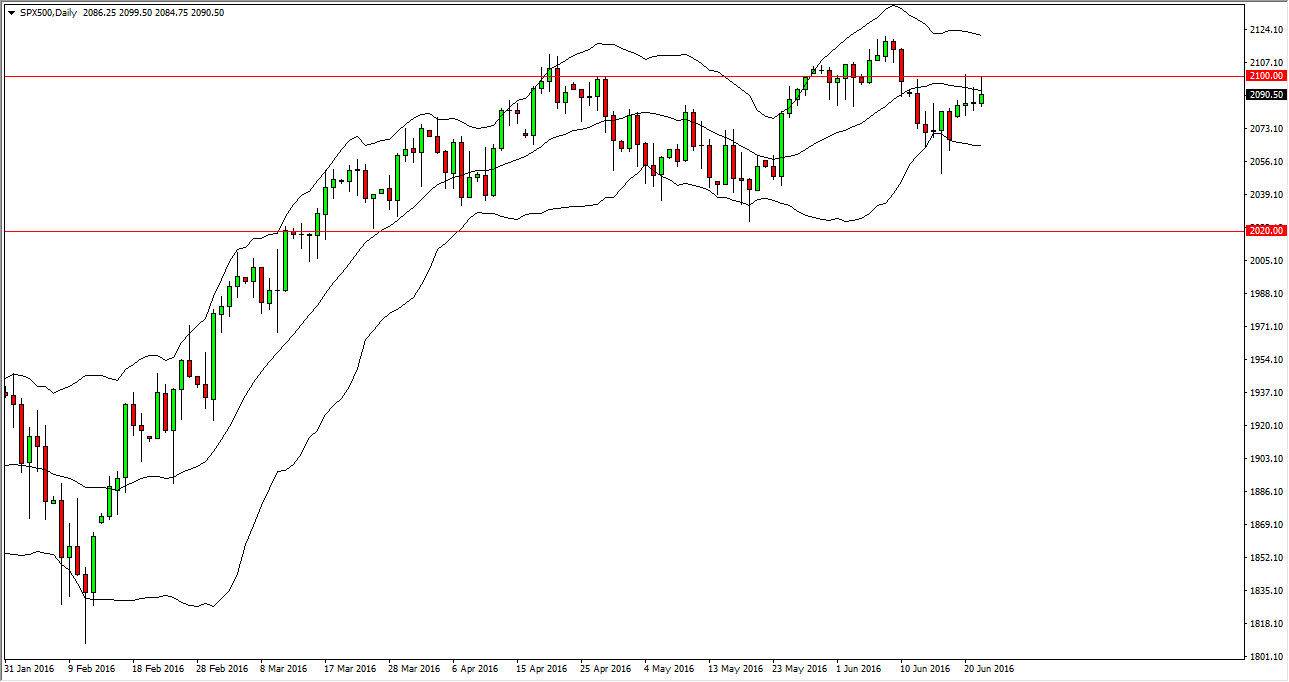

S&P 500

The S&P 500 initially tried to rally during the course of the session on Wednesday, but turned back around to form a shooting star. It is at the median line of the Bollinger Bands, as the markets continue to go sideways and weight upon the answer coming out of the United Kingdom as far as the European Union is concerned. We do not get the answer until tomorrow, so it’s very likely that this will be a very quiet session and therefore I don’t have any real interest in trading the S&P 500. If we did break above the 2100 level though, that would be a positive sign and I think at that point we could reach towards the 2120 level.

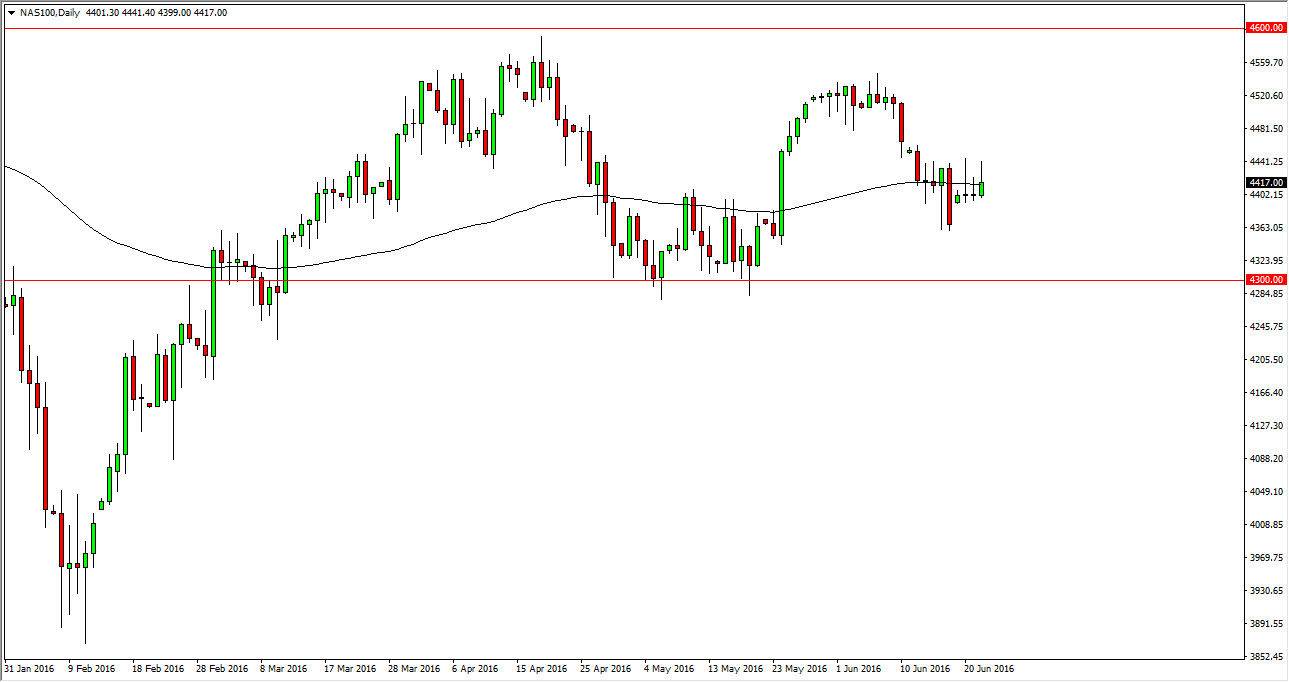

NASDAQ 100

The NASDAQ 100 initially tried to rally during the day on Wednesday, but turned back around to form a shooting star for the session. We also got the same shooting star on Monday and Tuesday, so this point in time it appears of the market simply cannot go anywhere. If we can break above the shooting star from the day though, at that point time I feel that the market could probably reach towards the 4500 level. Ultimately though, does look like we’re going to struggle so a slight pullback may be coming. There is so much in the way of support below though that I do not think that any fall from here will have any great momentum. In fact, I believe that the 4300 level will continue to be the bottom of the overall consolidation that the market is paying attention to. We are waiting for the European Union referendum vote in the United Kingdom, so it’s difficult to imagine that any real conviction will be shown in the markets today, as we are waiting to figure out what happens next.