USD/CHF Signal Update

Yesterday’s signals were not triggered as there was no bullish price action when the price reached 0.9742.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken between 8am and 5pm London time today.

Long Trades

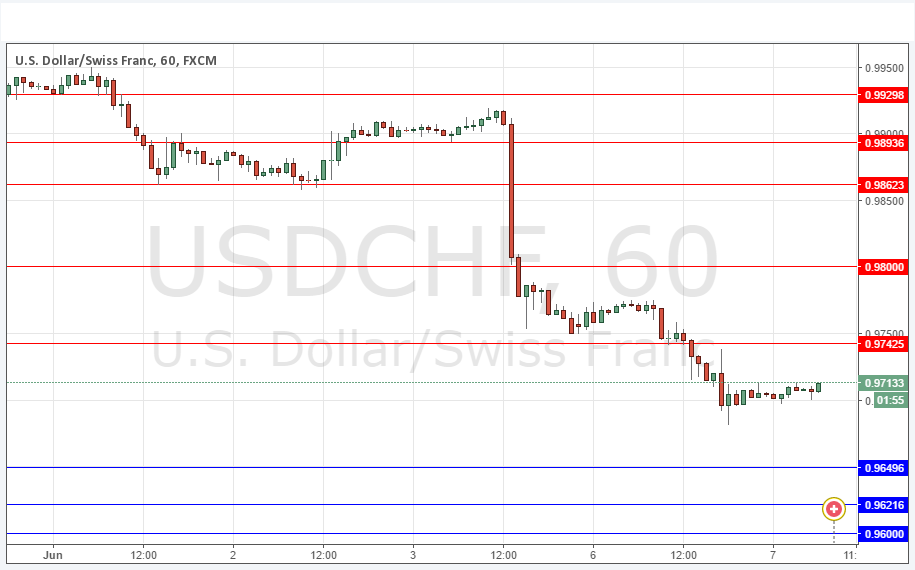

Long entry after bullish price action on the H1 time frame following the next touch of 0.9650, 0.9622 or 0.9600.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trades

Short entry after bearish price action on the H1 time frame following the next touch of 0.9800 or 0.9742.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

I wrote yesterday that this pair has more or less moved in tandem with the EUR/USD: a very strong push against the USD following the much poorer than expected U.S. economic data release last Friday making the prospect of a U.S. rate hike any time soon highly unlikely.

However this pair moved more strongly yesterday than the EUR/USD did, making new lows and breaking down past a well-defined support level at 0.9742. Therefore the picture here is now more bearish and a pullback and short from the 0.9750 could offer good value.

The area below from 0.9650 to 0.9600 can be expected to be very supportive, so could also be really interesting for a potential bullish reversal.

There is nothing due today concerning either the CHF or the USD.