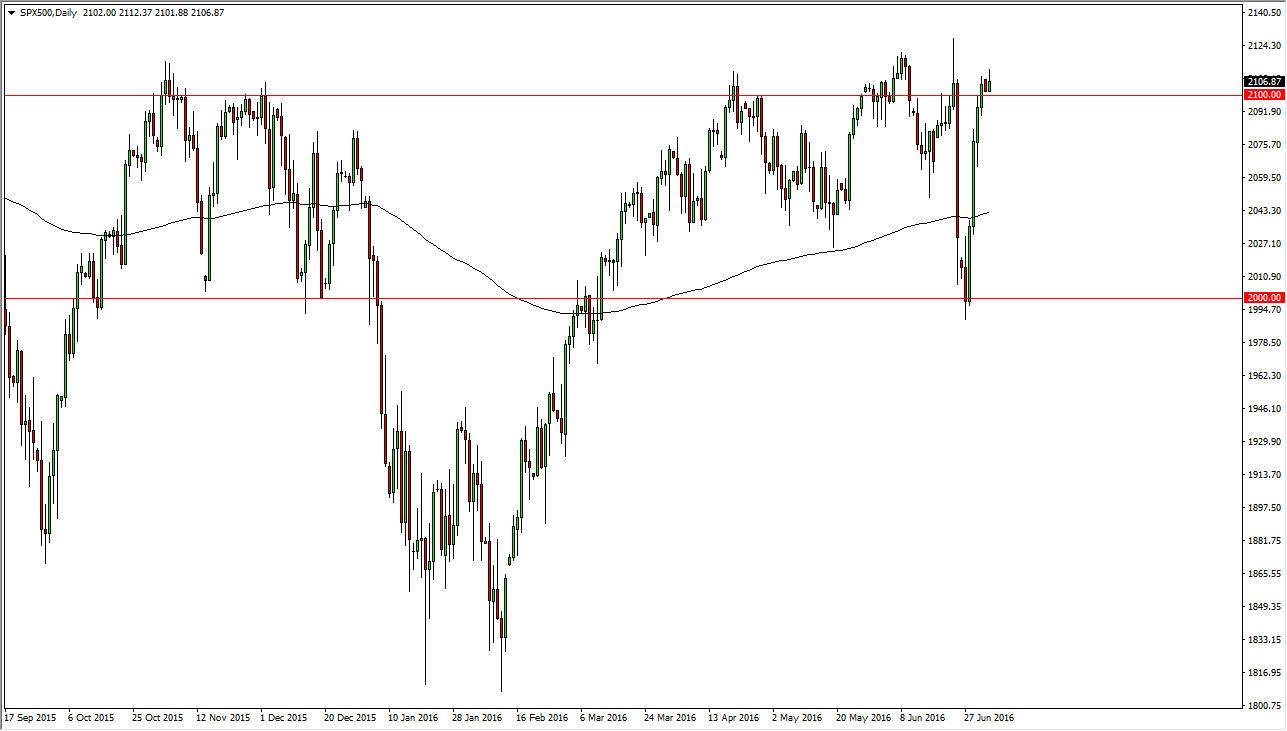

S&P 500

The S&P 500 of course was very quiet and the CFD markets did have a little bit of trading. With the Americans away at Independence Day holiday, it makes sense that we would have done almost nothing. I do have on this chart though the 2100 level marked off, and I believe that area should be supportive. I also have the 200 day exponential moving average marked on the chart which has been fairly supportive. I think that any pullback at this point in time should be a buying opportunity, and of course the market has seen quite a bit of buying pressure recently. On the other hand, if we can break above the top of the range during the session on Monday, it could be a buying opportunity as well.

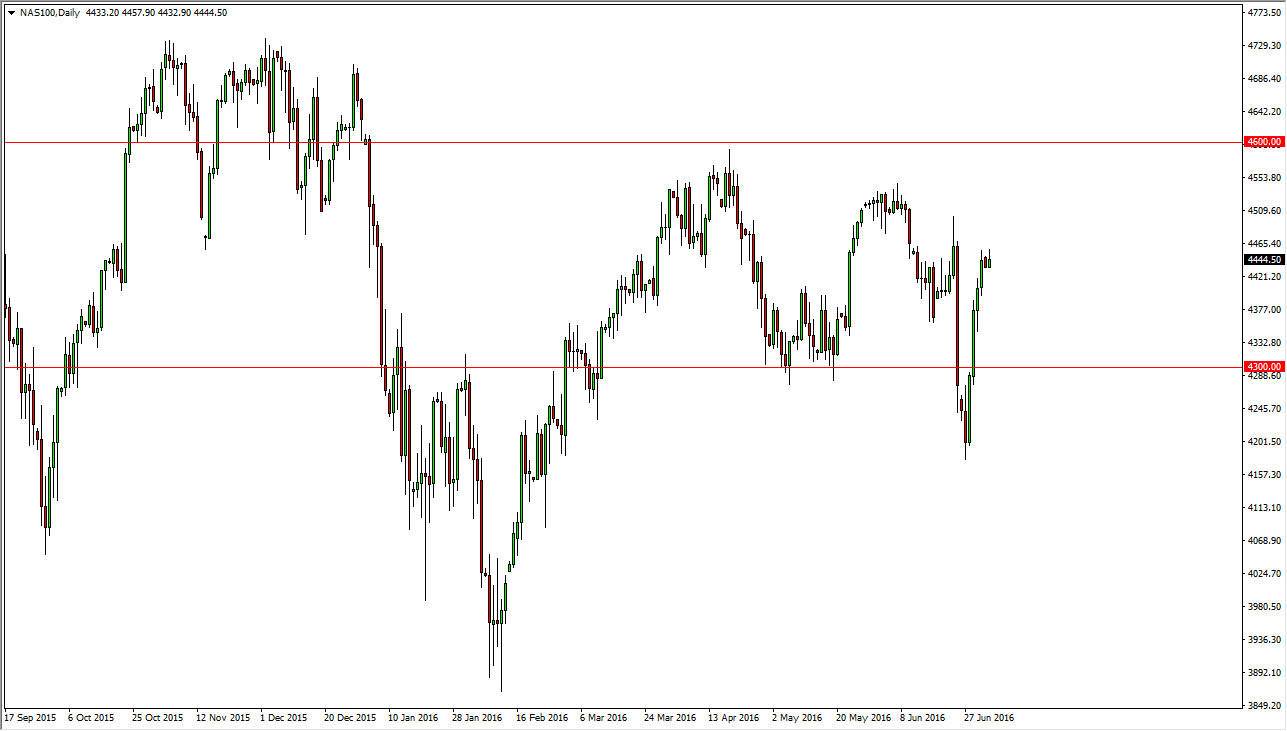

NASDAQ 100

The NASDAQ 100 initially tried to rally during the course of the day but turned right back around in the CFD markets as we ended up forming a bit of a shooting star. I believe that this is a sign that the market could pull back and perhaps try to look for value underneath and buying opportunities. A break above the top of the range for the day of course would be a buying opportunity also, but keep in mind that the NASDAQ 100 of course was and actually open during the day and is a bit overextended. Because of this, look at pullbacks as potential value in a market that should follow the S&P 500 in the Dow Jones Industrial Average, both of which look very bullish over the longer term. I have no interest whatsoever in selling this market as I believe we will try to reach the 4500 level, and then eventually the 4600 level above there.