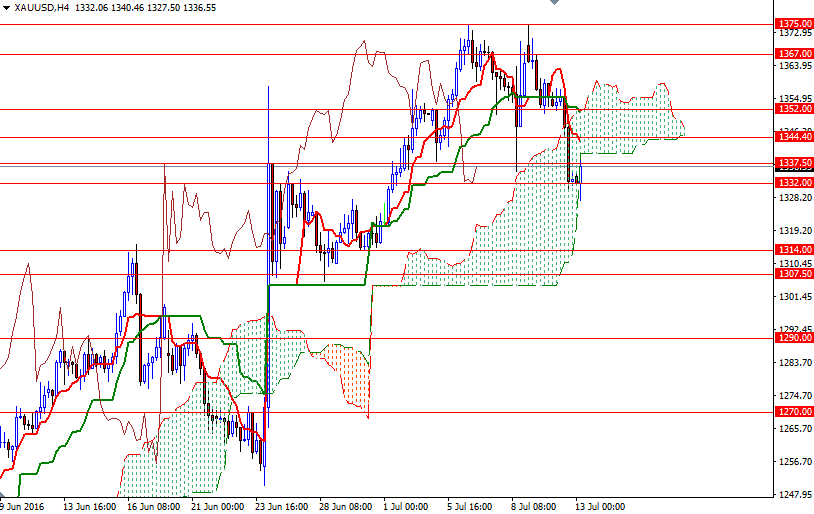

Gold prices fell 1.6% yesterday, extending their losses to a second straight session, as gains in equity markets eroded the appeal of the precious metal. The strength in the dollar and a breach of a key support at $1344 also contributed further pressure on the market. As a result, the XAU/USD pair slumped to $1330. Optimism about the American economy and easing political uncertainty in Britain may sap demand for safe havens for the time being.

Yesterday's drop dragged the XAU/USD pair into the Ichimoku clouds on the 4-hour time frame. The market bounced off the support at around 1330 but the bulls will need to push prices back above the 1339/7.50 area if they intend to tackle the 1344.40 resistance. Beyond that, keep an eye on the 1355.20-1352 zone which stands out as obvious support flipped to resistance. Since closing above this level would put the short term technicals in the same direction with the overall trend, it wouldn't be so surprising to see the market visiting 1362.

On the other hand, if the bears take the reins and 1332/0 is breached, we will probably see prices fall to 1325. A break down below 1325 would imply that the 1320 level will be the next stop. The bears have to capture this camp so that they can force the market to test the 1314 level.