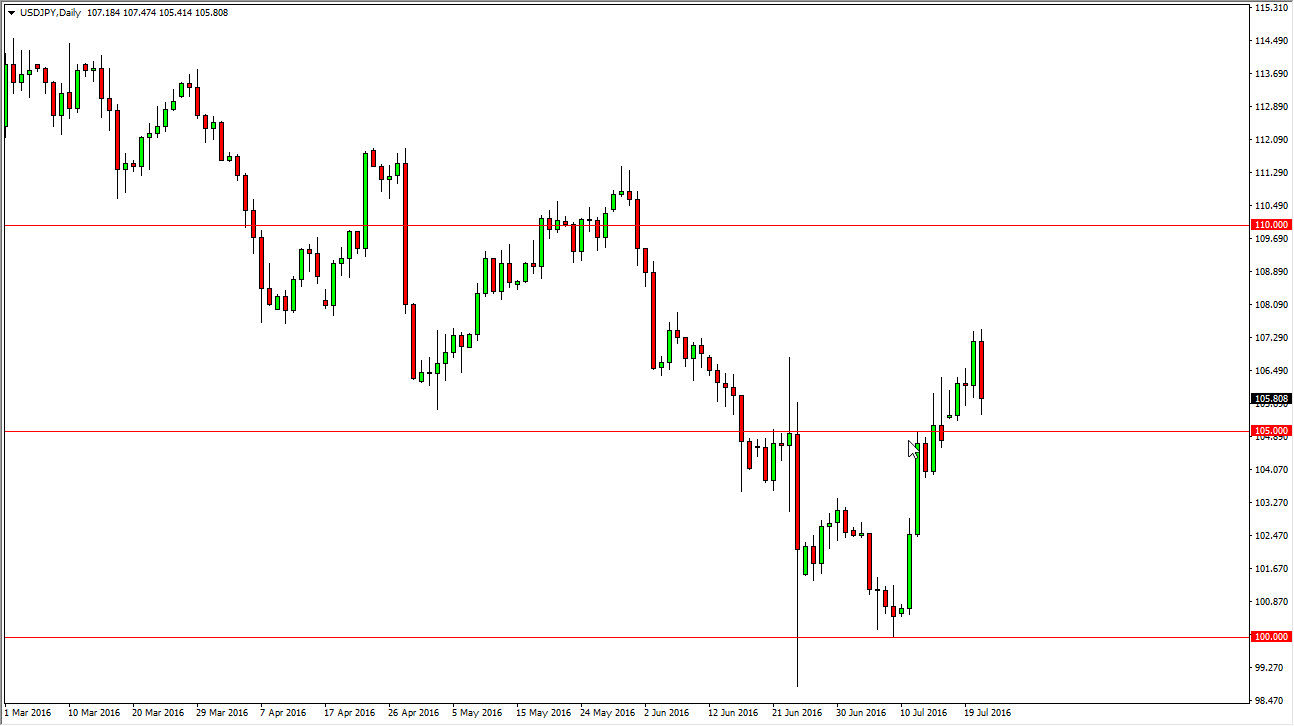

USD/JPY

The USD/JPY pair fell significantly during the course of the day on Thursday, as we have broken down and turned around completely the bullish pressure that we had seen during the previous day. However, I see quite a bit of support at the 105 level, and as a result I believe that it is going to be difficult to go much lower. I think a supportive candle would be a nice buying opportunity and the pullback is quite frankly needed at this point in time as we have been a bit overextended for a while. To be honest, I would have to see this market drop down below the 104 level to even consider selling. After all, the Bank of Japan is continuing to show its displeasure with the extremely high value of the Japanese yen.

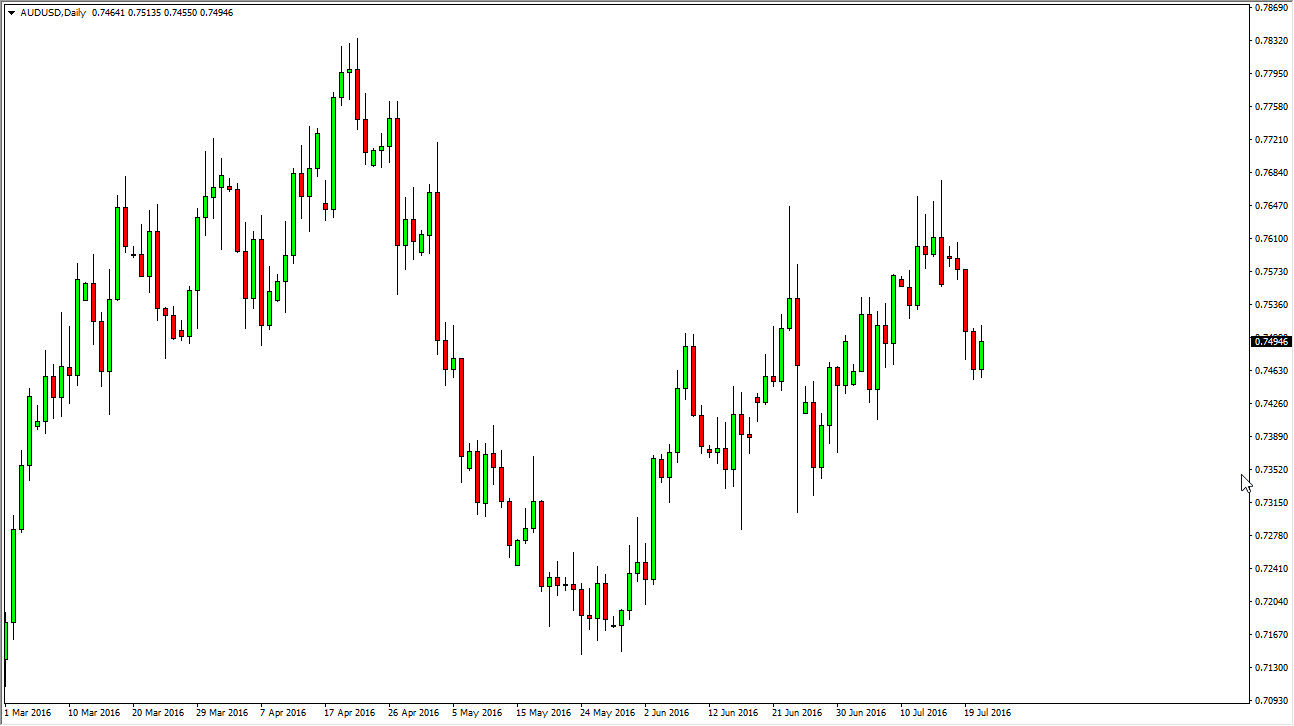

AUD/USD

The AUD/USD pair broke higher during the day, attempting to get above the 0.75 handle. However, this is a market that although has been bullish lately, it does have its own issues. After all, the Reserve Bank of New Zealand has recently suggested that they may have to cut interest rates, and that tends to have a bit of a “knock on effect” when it comes to the Australian dollar. Ultimately, the gold markets also have an effect on this market in the have pullback recently. I think that this is still in an uptrend though, so we can break above the top of the range for the Thursday session, we could very well try to reach towards the 0.7650 level.

I think that if we can break down below the lows of the Thursday session, it’s likely that we could drop down to the 0.73 handle, but it is going to be very noisy all the way down there. After all, there are a lot of little micro-supportive areas below, so expect a bumpy ride to the downside if we do selloff.