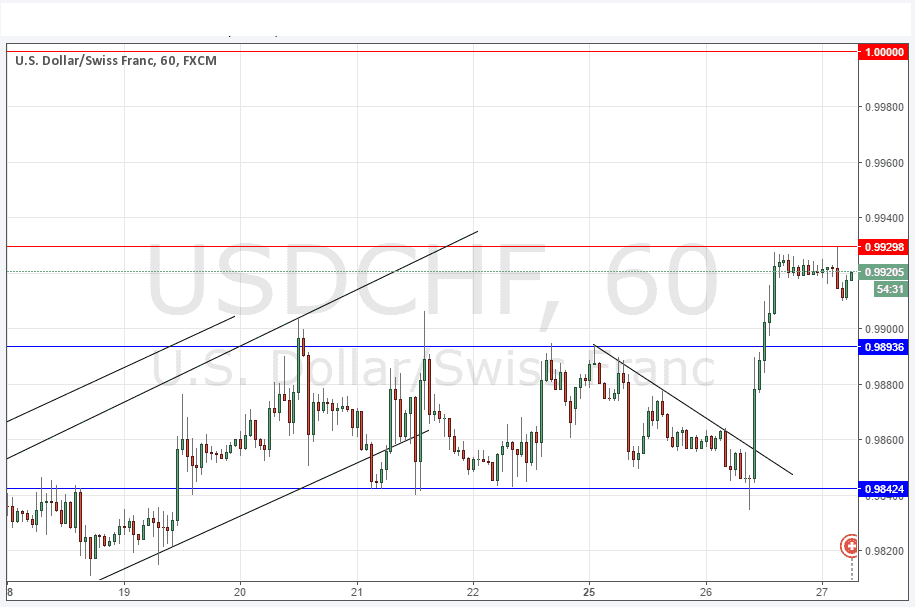

USD/CHF Signal Update

Yesterday’s signals produced an excellent long trade from the break of the bullish pin candle on the H1 chart that rejected the support level at 0.9844 during the first half of the London session. It is time to take more profits if not already done. The maximum reward to risk achieved so far is excellent: almost 5 to 1.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today only.

Protect any open trade by 6:30pm London time.

Long Trades

Go long after bullish price action on the H1 time frame following the next touch of 0.9894 or 0.9844.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short after bearish price action on the H1 time frame following the next touch of 0.9930 or 1.0000.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

I was looking out for support at 0.9844 but I had seen a break down below that level as the more probable scenario. However there was strong buying there and after rising and breaking the bearish trend line, the price suddenly shot up to 0.9900 and beyond. The price has even come very close to the next resistance level at 0.9930.

In light of this strong upwards move, it is likely that the previous resistance at 0.9894 is now going to flip to become support, so if there is any pullback to this level, watch the price action very closely.

There is nothing due today concerning the CHF. Regarding the USD, there will be a release of Core Durable Goods Orders data at 1:30pm London time, followed by Crude Oil Inventories at 3:30pm, ending with the FOMC Statement and Federal Funds Rate at 7pm.