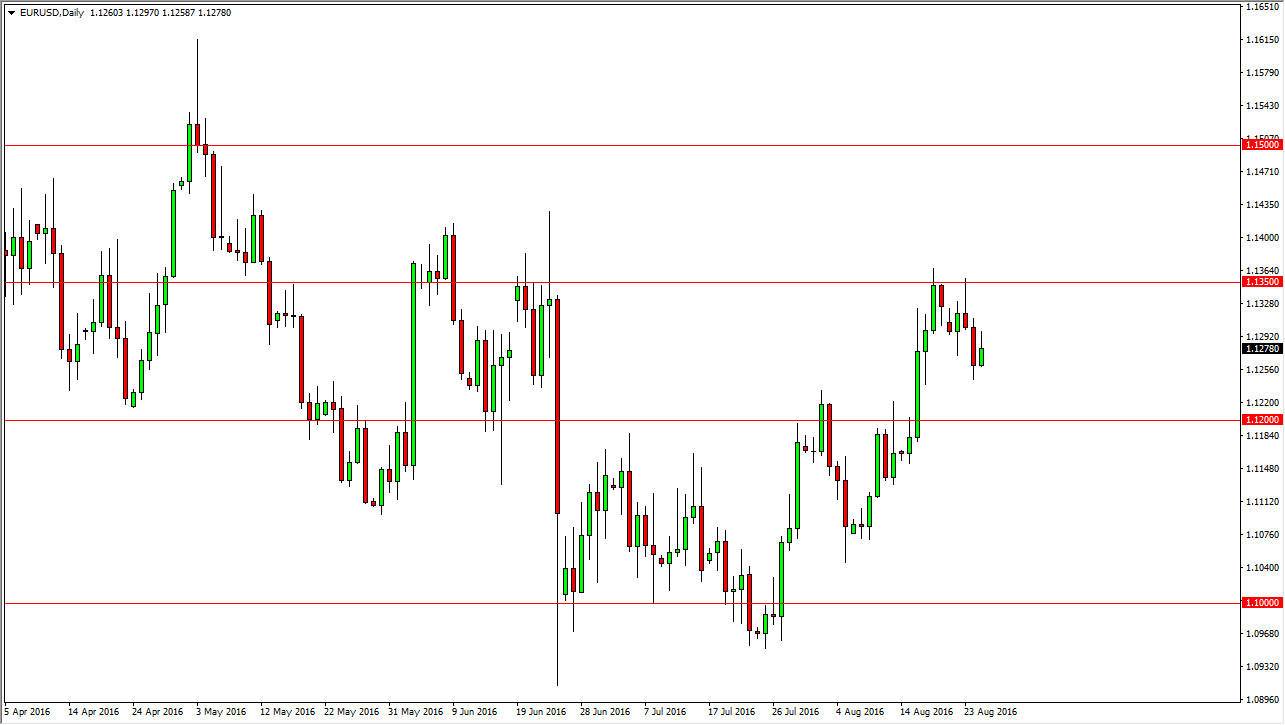

EUR/USD

The euro had a slightly positive session during the day on Thursday, but did get back about half of the gains towards the end of trading. With this being the case, looks as if the market does look like a lead to try to grind higher, but I think there’s a lot of noise in this marketplace, and as a result it might be difficult to hang onto the trade for any real length of time. I see this is a market that is simply bouncing around between the 1.1350 level on the top, and the 1.12 level on the bottom. Volatility will be something you can probably count on, but it might be in slow motion essentially as we are in the middle of the holiday season.

GBP/USD

The British pound fell during the day, as we have recently seen time and time again. The short-term rally that has shown itself over the last several sessions has been done in a very low volume environment, so I don’t read too much into it. In fact, I believe that once the volume picks up after the summer break, people will come back to start selling the British pound again. What you can make an argument that the Americans can’t raise interest rates this year, at the end of the day the book to leave the European Union still has a lot of people concerned about the health of the British economy overall, which has been slowing down a bit.

At this point in time, I believe that the market will start reaching towards the 1.2850 level, but it won’t necessarily be an easy move. After all, most of the market participants are way of the moment so we don’t have any real conviction. Ultimately, rallies that show signs of exhaustion are selling opportunities as far as I can see, and I maintain that to be true.