EUR/USD

The Euro fell significantly during the course of the session on Wednesday, as we continue to see quite a bit of volatility. Ultimately, I believe that this is a market that will continue to chop around overall. However, I do recognize that the 1.12 level below should be a bit of a “floor” in this market, so a supportive candle below should be a nice buying opportunity. I think that the 1.1350 level will of course offer quite a bit of resistance as well, so at this point in time it’s going to be difficult to make quite a bit of a move for any real distance, because we are in the middle of the high vacation season. With that, expect a lot of noise and quite frankly don’t want to be bothered.

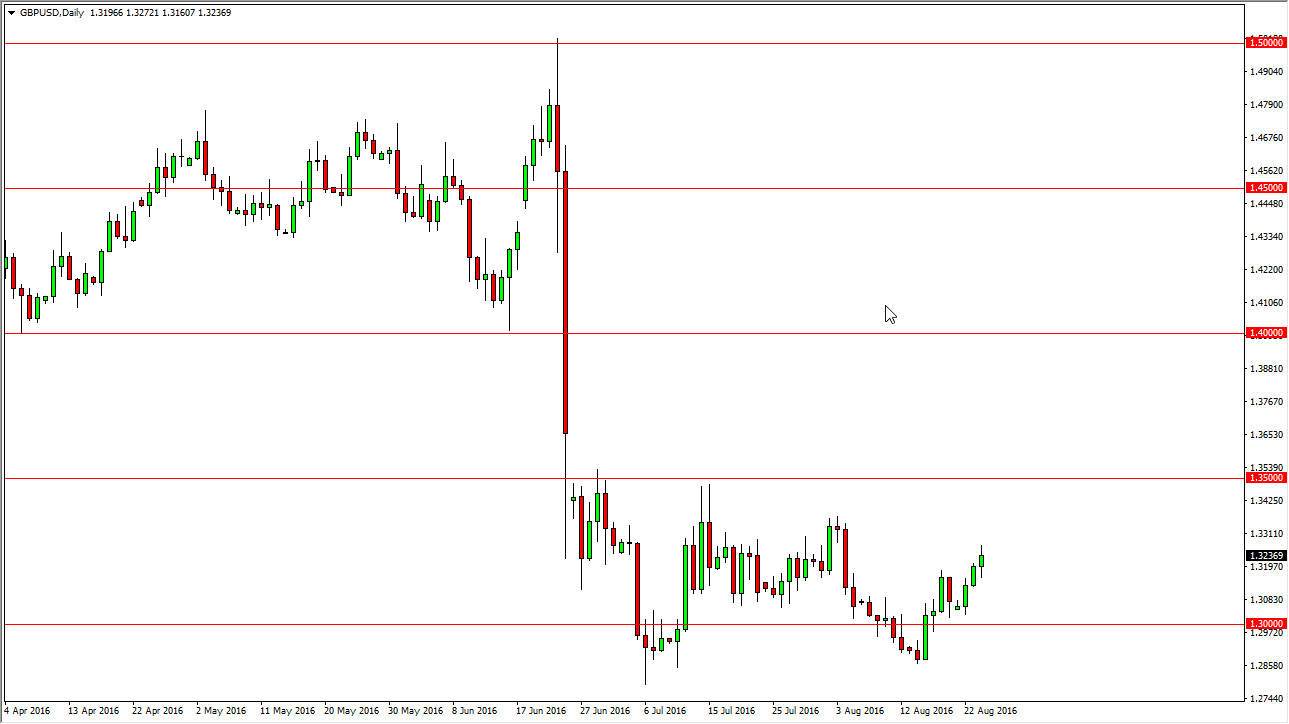

GBP/USD

The GBP/USD pair went back and forth during the course of the session on Wednesday, forming a bit of a neutral candle. Ultimately, I think that the market will rally from here a bit more, but eventually find enough resistance above to turn this market back around in an attempt to continue the overall consolidation area that we have seen for several weeks now. Because of this, I think that it makes sense that eventually the sellers get involved because quite frankly they have every time we have gotten close to the 1.34 handle.

Ultimately, if we break above there, I think the real top of the market is closer to the 1.35 handle, so at this point in time I think it’s simply prudent to wait for an exhaustive candle to continue to sell yet again as the British pound will more than likely break down due to the vote to leave the European Union, and I believe that once traders can back into the marketplace, they will resume what they had been doing before vacation.