GBP/USD Signals Update

Last Thursday’s signals were not triggered as there was no bullish price action when the price reached 1.3164.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm London time today.

Long Trade 1

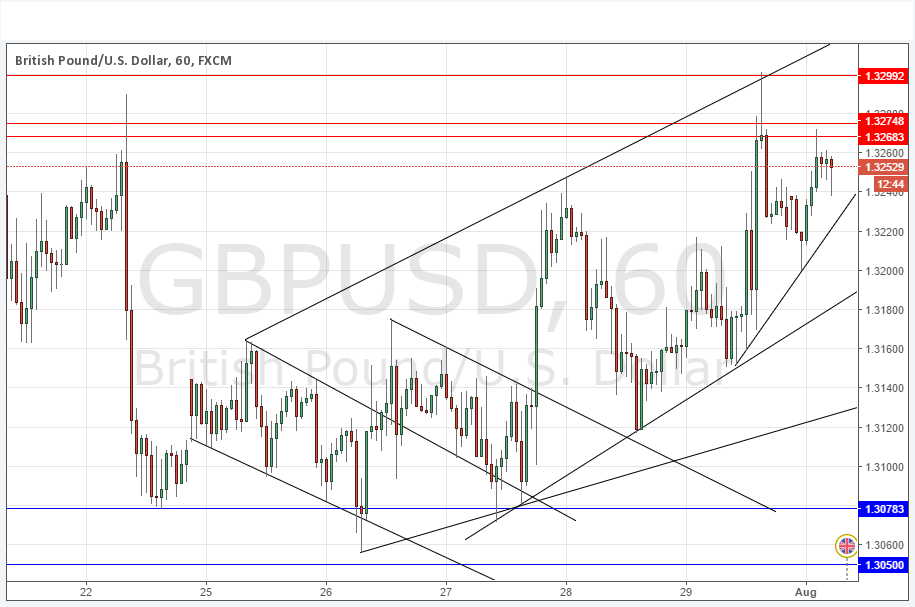

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3078.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 1.3268 and 1.3300.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

GBP/USD Analysis

This pair has become established in a bullish channel, with ascending supportive trend lines, as shown in the chart below. The price has been driven into an area of key resistance, from which it has been rejected several times over recent days, and twice over recent hours of trading. A further rejection from this zone followed by a break below the highest ascending supportive trend line will probably be the cue for a move back down which could be quite sharp, and which should reach to at least 1.3120.

Alternatively, a strong and sustained break above 1.3300 is likely to begin a move up to the 1.3500 area.

Concerning the GBP, there will be a release of Manufacturing PMI data at 9:30am London time. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm.