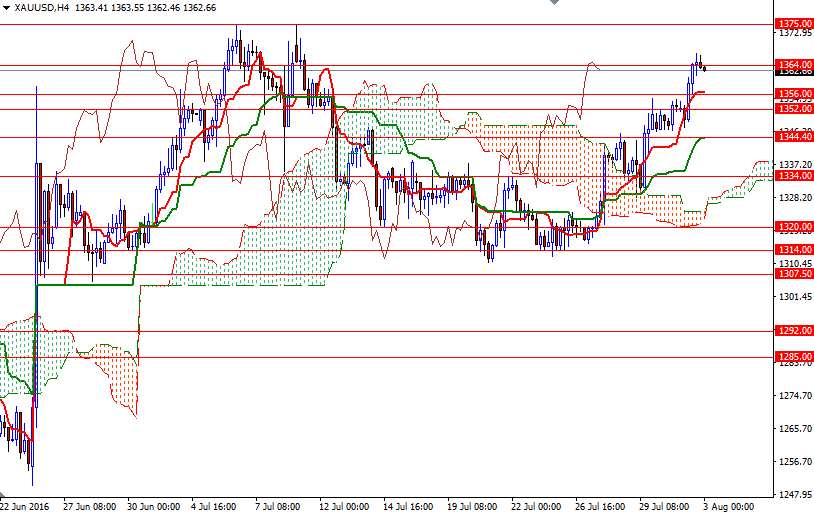

Gold prices rose $10.91 an ounce on Tuesday, up for the third straight session to $1363.31, as a softer dollar and sagging risk appetite made gold more attractive as an alternative asset. The greenback remained weak on perception that bleak us growth would keep the Federal Reserve from raising interest rates soon. Major stock indexes posted heavy losses and crude oil prices continued to drop, settling below $40 a barrel for the first time since April. The XAU/USD pair extended its gains after the $1356/2 resistance was broken and reached the $1364 area as expected.

The U.S. economy is in focus today with services PMI figures and the ADP employment report coming up. The market is currently wondering around the 1364 level and it seems that we are going to remain stuck in a narrow range until the release of data. From a technical perspective, trading above the Ichimoku clouds on the 4-hour time frame gives the bulls an advantage. In addition to that, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are positively aligned and the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices.

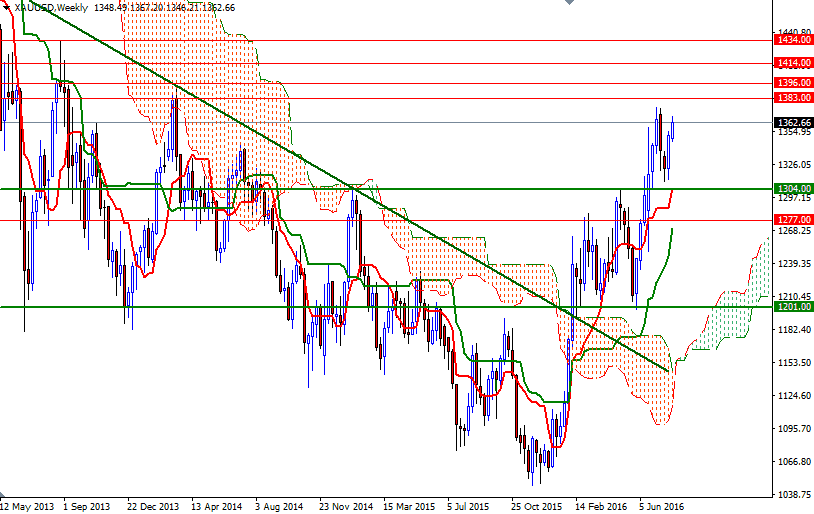

The XAU/USD pair has to push its way through the 1371-1368.50 resistance zone in order to tackle the 1375 area which blocked the bulls’ way last month. Closing above this strategic level is essential for a bullish continuation towards 1396. On its way up, resistance can be found at around 1383. To the downside, the initial support stands in the 1360.50-1360. If prices falls through 1360, then the market may revisit 1357/6 and 1352. The bears have to drag XAU/USD back below 1352 if they intend to increase the pressure on the market and march towards 1346/4.