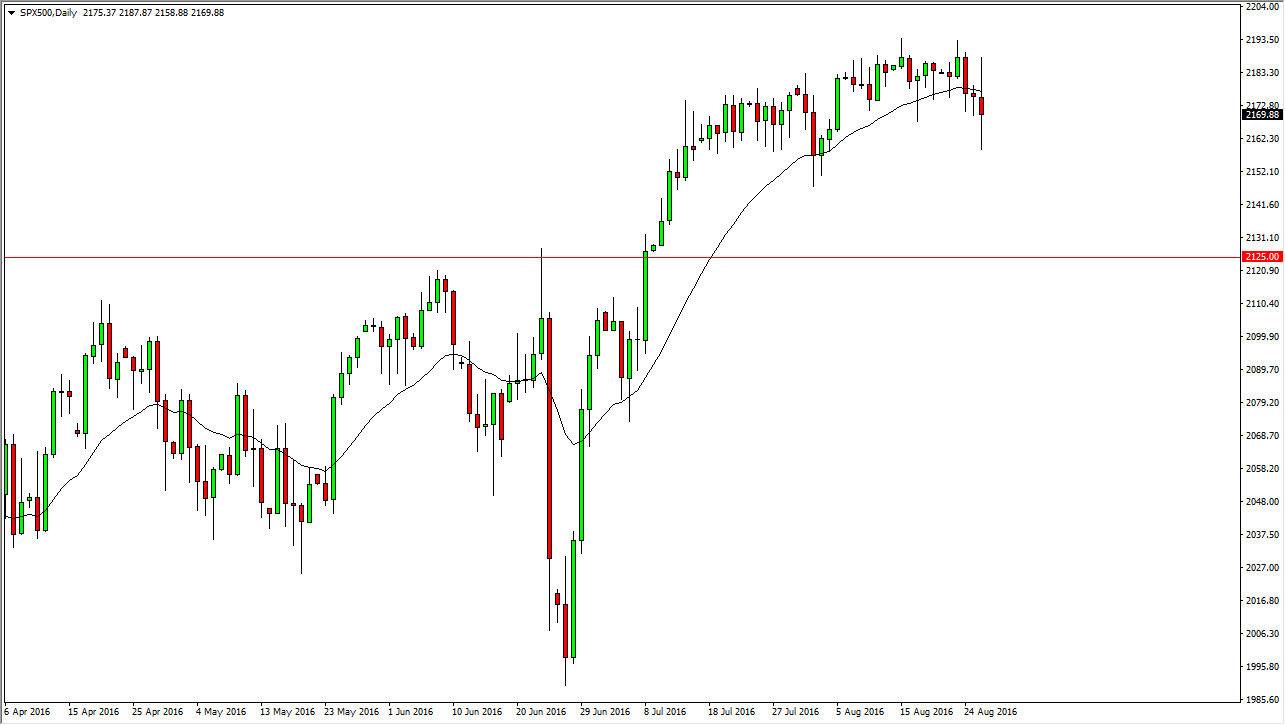

S&P 500

The S&P 500 went back and forth during the day on Friday in a very volatile session. When it up just slightly down though, and as a result I think we are going to continue to see quite a bit of sideways action. Volatility will be the order of the day, and of course could pick up at any moment. With this being the case it’s likely that we will have to stick to short-term charts. I still have an overwhelming positive bias, especially considering that the sellers couldn’t keep the market down in the end. With this being the case, I’m looking for short-term buying opportunities at this moment. After a while and more importantly one the volume picks back up, I expect us to go much higher.

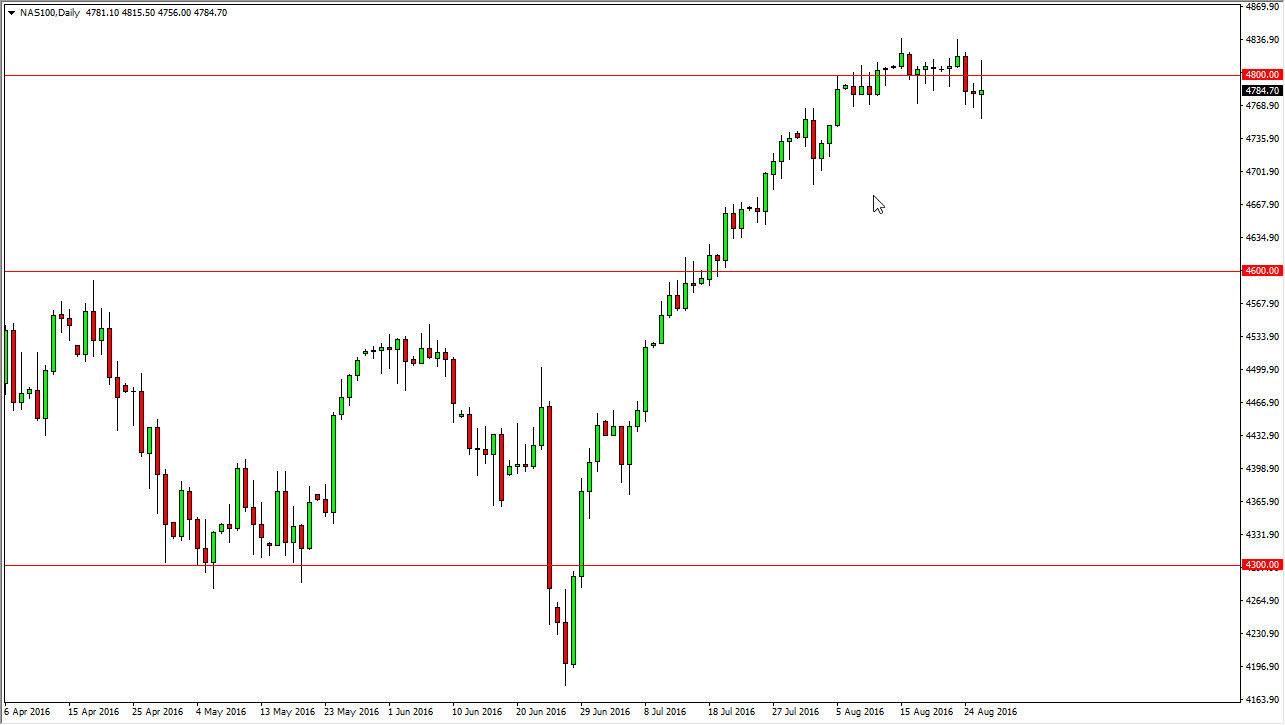

NASDAQ 100

Obviously, the NASDAQ 100 did very much the same thing as we continue to bang up against the 4800 level. With this being the case, I think that eventually we will break out towards the 5000 level as I have been saying, but I also recognize that it might take a minute to get there. Buying pullbacks continue to offer buying opportunities based upon support, but I’m not a big fan of using a lot of leverage in this market right now. I think there are going to be possible significant pullbacks from time to time, but given enough time we should reach towards the 5000 handle.

The market has been overextended for some time though, so having said that it makes sense that we go sideways during this very low volume time of the year. Ultimately though, I think that this market will find the buyers more than willing to step in, because quite frankly there’s going to be too much uncertainty when it comes to Europe and Great Britain. With fact, it’s just safer to invest in the United States.