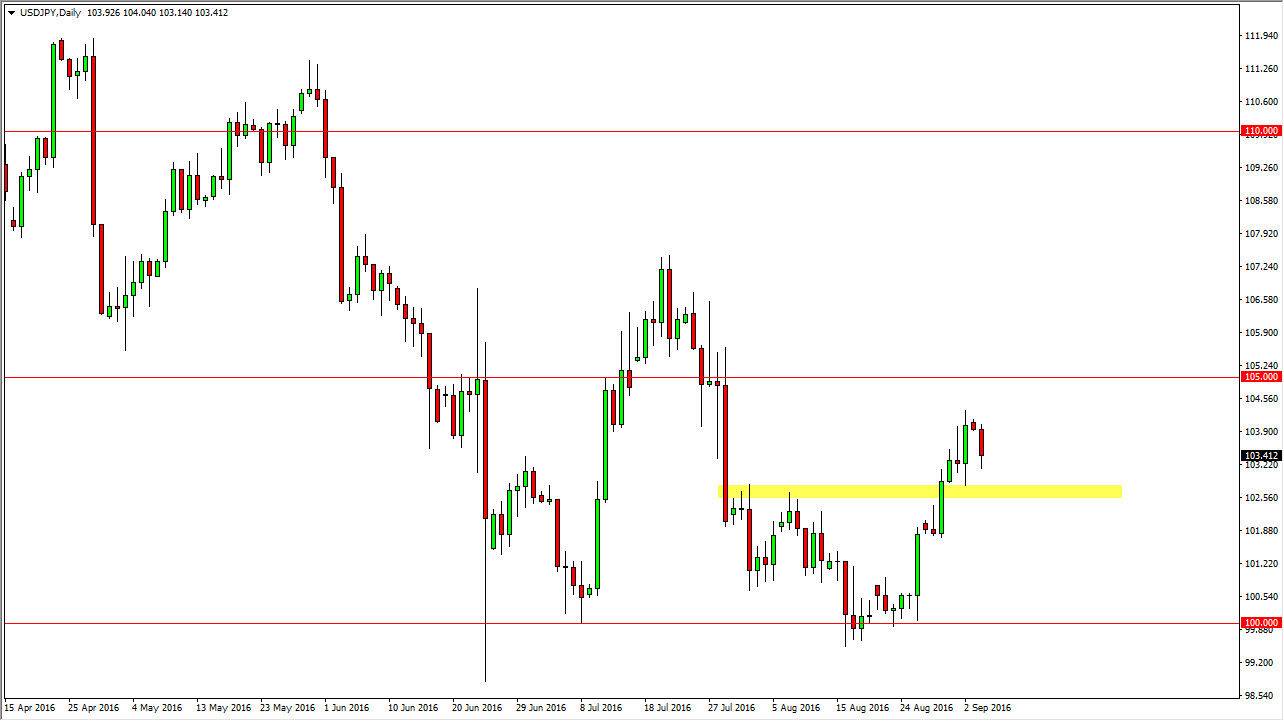

USD/JPY

The US dollar fell against the Japanese yen during the session on Monday, but one thing you have to keep in mind is that the volume simply wasn’t there. After all, the Americans and Canadians both were celebrating Labor Day, and as a result you have to take the move with a little bit of a grain of salt. However, I do think that there is a significant amount of support somewhere near the 102.50 level, and as a result it’s only a matter of time before we bounce. That’s my base case argument, and I’m waiting to see whether or not we get the right supportive candle that we can take advantage of. With this, I’m eventually a buyer but I also recognize that it could be choppy over the next several sessions.

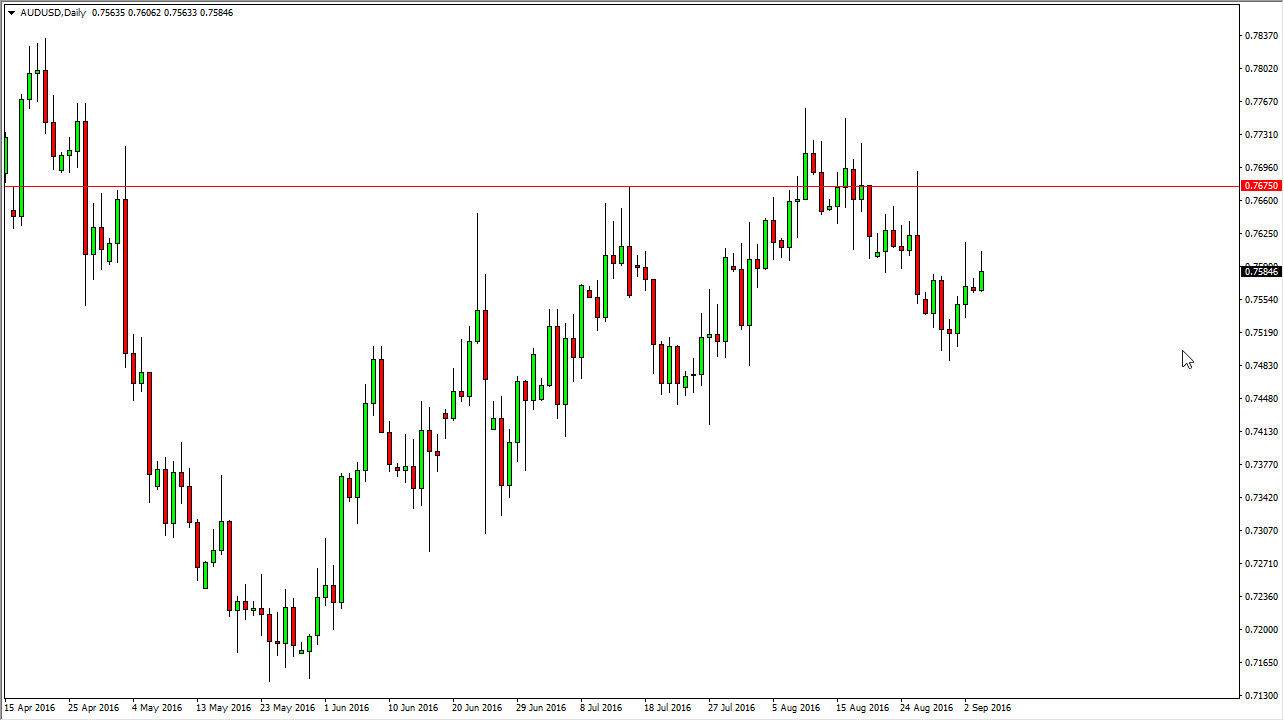

AUD/USD

The Australian dollar rally as well, but you can also see that we failed to hang onto most of the gains. However, you have to say that the interest-rate decision coming out today will be a major influence on the Australian dollar, and where it goes next. I would suggest that perhaps we are probably going to drop from here, although it is a necessarily going to be some type of massive selloff. I believe that the market will gradually grind its way lower but I also recognize that gold markets can have an influence on this pair as well. Because of this, you have to keep an eye on that market as well, but with that being the case expect quite a bit of volatility in choppiness.

Ultimately though, this is a market that I think is probably best left alone, at least until we can get some type of clarity, which might be a week away as traders continue to come back to work after the vacation season. With this, I’m trying to be as patient as possible.