USD/CHF Signal Update

Yesterday’s signals might have given a losing long trade following the doji rejecting the support level at 0.9735, which would have been a losing trade.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken between 8am and 5pm London time today.

Long Trades

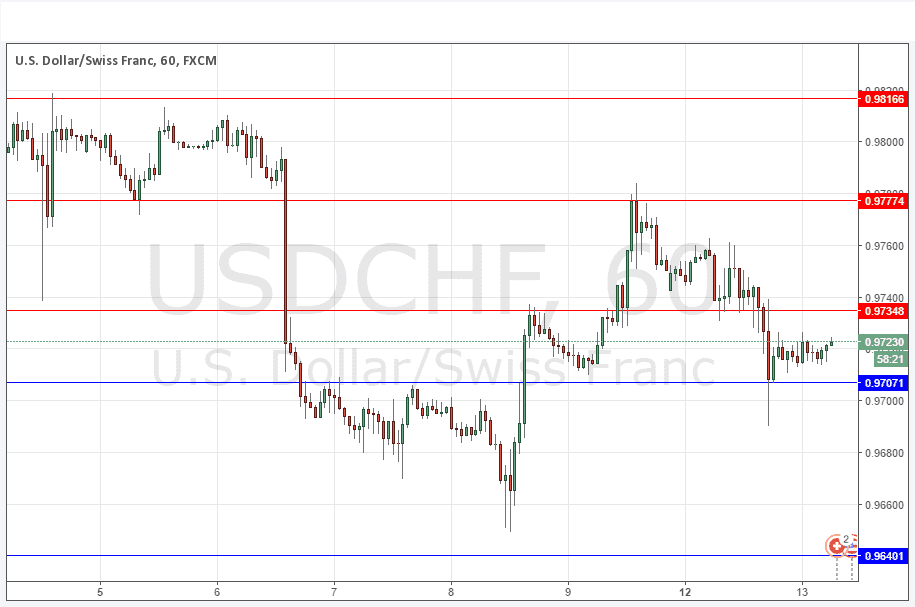

Long entry after bullish price action on the H1 time frame following the next touch of 0.9707 or 0.9640.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trades

Short entry after bearish price action on the H1 time frame following the next touch of 0.9735 or 0.9777.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

This pair is within a long-term consolidation and it is not just a consolidation, it is vibrating almost to reduce itself to a singularity – basically, becoming very lifeless. In this kind of long-term environment, it is extremely difficult to trade this pair. One can only hope for relatively extended moves followed by strong reversals off key levels. Although we are close to some key levels, the nearest support looks unreliable and the nearest resistance does not fill me with confidence either.

Any opportunities today are most likely to found trading other currency pairs.

There is no high-impact news due today concerning either the CHF or the USD