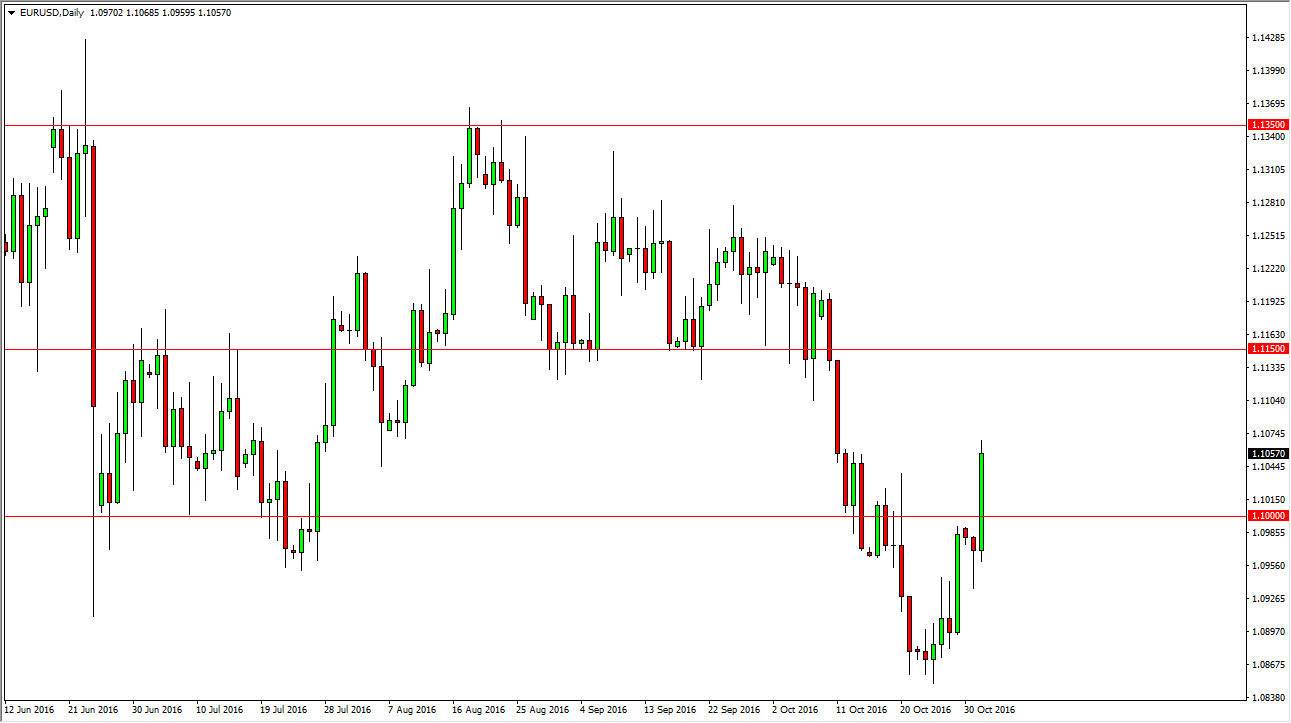

EUR/USD

The Euro broke higher during the day on Tuesday, clearing the top of the hammer from the Monday session. With that being the case, it looks as if the market is trying to go higher, and it’s very possible we may bounce all the way to the 1.1150 level. An exhaustive candle above should be a nice selling opportunity, as the resistance above is massive. With this being the case, I am simply waiting to see exhaustion as it could continue the longer-term downtrend. Ultimately, this is a market that is probably reacting to the presidential polls in America more than anything else, and quite frankly this should be a “knee-jerk reaction” that we can take advantage of at higher levels. I would be very surprised we didn’t turn right back around and start falling soon.

GBP/USD

The British pound did very little during the course of the session on Tuesday, as we continue to hover just above the 1.20 level. This is an area that has been very supportive in the past, and as a result it might take several attempts to break down below there. Rallies at this point in time will be selling opportunities as soon as we exhaustion, as the 1.2850 level above is massively resistive. Because of this, I believe that simply waiting for “value” in the US dollar is probably the way to go.

I have no interest in buying the British pound as I think there is still quite a bit of negativity around market. With that being the case, it’s very likely that we will get several opportunities to sell again and again as although there is quite a bit of negativity, we are going to have to work our way through it. Expect volatility regardless of whatever happens next.