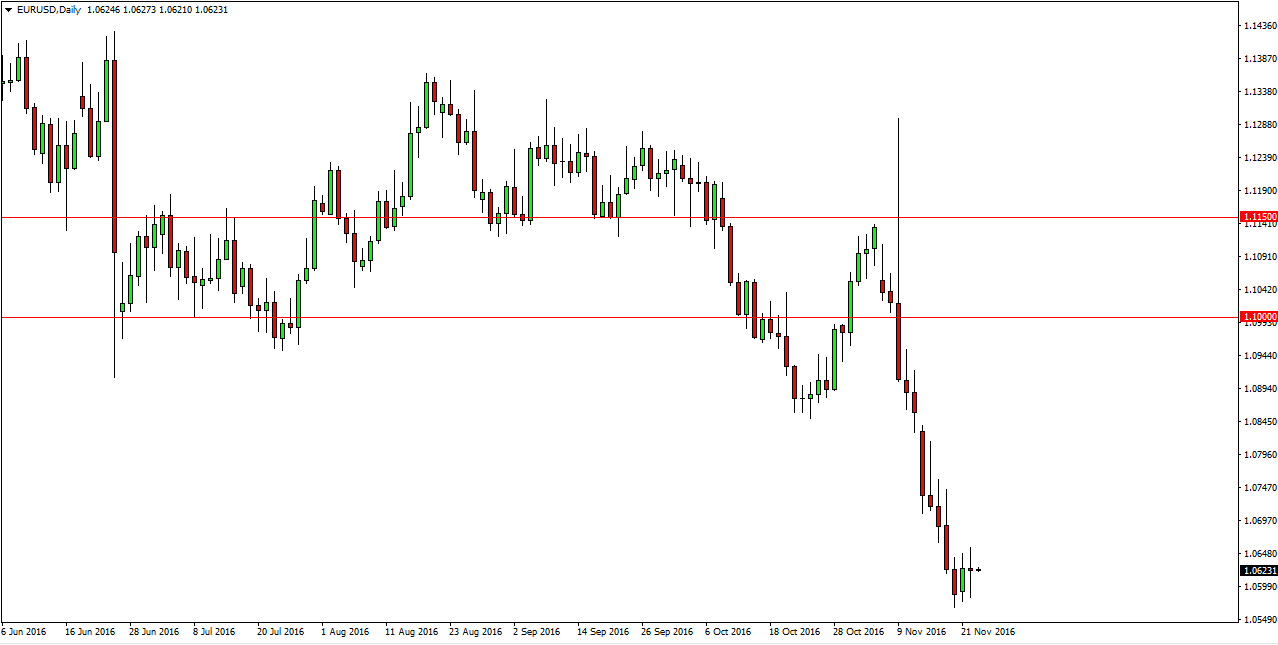

EUR/USD

The Euro continues to bounce around the 1.06 level, and of course the Tuesday session wasn’t any different. This is a market that cannot pick up any steam to the upside, but quite frankly I am a bit concerned about the 1.05 level below. That’s an area that’s can take quite a bit of effort to break down, and as a result I would anticipate some type of short-term rally coming soon. However, I don’t necessarily think that this rally is going to be anything more than “value” in the US dollar. I look for exhaustion after the short-term rallies to sell, but quite frankly it hasn’t happened yet which is a bit of a surprise. Nonetheless, I have no interest in buying whatsoever.

GBP/USD

The British pound drifted a little bit lower during the day as the 1.25 level continues to offer quite a bit of resistance. I still think that we are in the general downward motion when it comes to the cable pair, but I also recognize that a bounce could help the situation as we had sold also drastically. I believe that the 1.20 level below is massively supportive, and that it could take several attempts to break below there. I also recognize that the 1.2850 level above is resistance, so any rally should run into quite a bit of trouble between here and there.

I believe that exhaustive candles on short-term rallies are the way to go going forward, and with the Thanksgiving holiday coming tomorrow, we will have a bit of a lack of quiddity when it comes to the marketplace. Because of this, I expect the market to be fairly muted over the next couple of days as we try to figure out where to go next. Once we get through the Thanksgiving holiday, things tend to calm down a bit and therefore most of the major moves may have already happened.